What is Octotrader AI?

Octotrader AI is an innovative and sophisticated algorithm that integrates Artificial Intelligence with traditional technical analysis to forecast market movements. One of its standout features is a groundbreaking recovery mode, which divides each entry into multiple smaller trades, closing them sequentially to maximize profits from successful trades. This dynamic trading strategy adjusts to your account size and includes advanced functionalities tailored for prop firm trading. Additionally, it prioritizes safety with drawdown limiters and a highly customizable risk management system, ensuring a secure trading experience.

- Vendor website: https://www.mql5.com/en/market/product/106677

Original price: $399

Forex EAs Mall price: $25 (you save 95%)

Highlighted Features:

- Dynamic Lot Sizing: Adjusts lot size automatically based on account balance and risk levels.

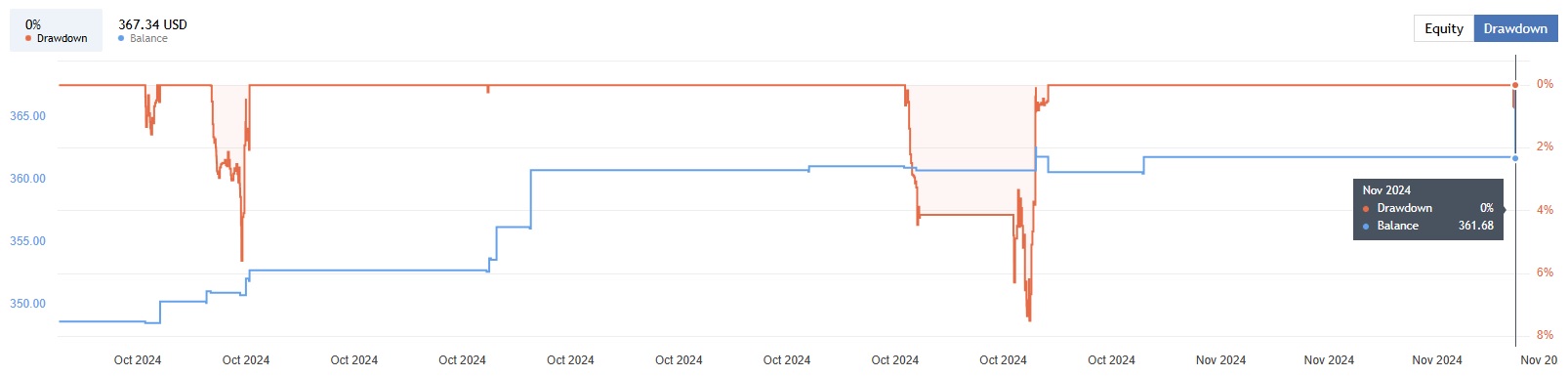

- Drawdown Limiters: Protect your account from excessive losses with maximum account and daily drawdown controls, making it ideal for Prop Firm Trading.

- Trailing Take Profit: Set trailing take profits to secure gains and maximize potential profits from strong price movements.

- Batch Trading: Open multiple trades per batch for more flexible position management.

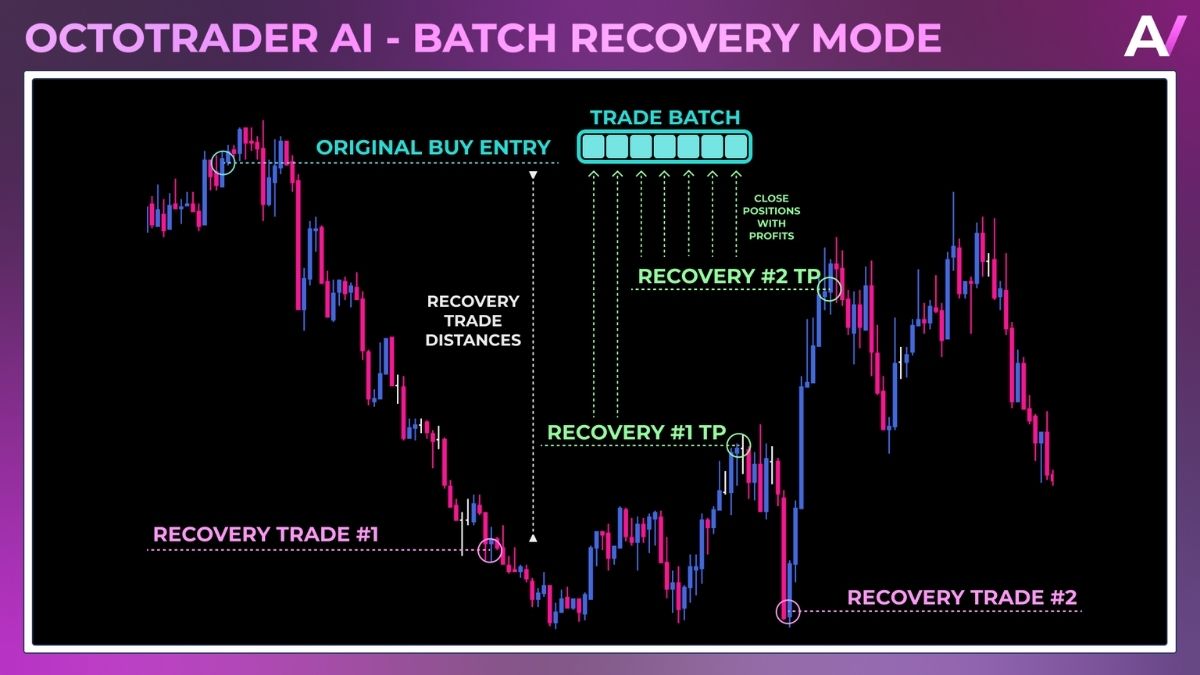

- Recovery Mode: Attempt to recover losing positions with additional trades, based on a flexible recovery strategy.

- News Filter: Avoid trading during high-impact news events with an integrated news filter.

- AI-Powered Market Forecasting: Combines Artificial Intelligence with traditional technical analysis to enhance market predictions and trading precision.

- Innovative Recovery Mode: Utilizes a unique strategy by dividing each trade into smaller parts, closing them incrementally to secure profits from successful trades.

- Adaptive Trading Strategy: Automatically adjusts trade settings based on your account size, creating a tailored experience that aligns with various trading goals, including prop firm requirements.

- Enhanced Risk Management: Offers customizable risk settings and built-in drawdown limiters, providing robust protection for your capital and peace of mind.

- Tailored for Prop Firm Compliance: Designed to meet the needs of prop firm traders, with configurations aimed at staying within common prop firm risk limits and maximizing capital efficiency.

How Octotrader AI Works:

- Used on platform: MetaTrader 4.

- Currency pairs: EURUSD.

- Time frame: M5

- EA trading automated 100%.

- Minimum deposit: 200$.

- Leverage: Any.

- Every position always has a fixed or trailing Take Profit and a fixed Stop Loss set from the beginning.

- Adjusts lot size automatically based on account balance and risk levels.

- Protect your account from excessive losses with maximum account and daily drawdown controls, making it ideal for Prop Firm Trading.

- Set trailing take profits to secure gains and maximize potential profits from strong price movements.

- Open multiple trades per batch for more flexible position management.

- Attempt to recover losing positions with additional trades, based on a flexible recovery strategy.

- Avoid trading during high-impact news events with an integrated news filter.

Mechanics:

Instead of opening just a single trade, this EA will open multiple smaller trades at the same time. If the market changes and the position becomes a loss, the EA will gradually close the losing positions with the profits gained from additional trades.

The EA includes powerful risk management features, including maximum drawdown limits for both the account and daily trading activity, ensuring you stay within your desired risk parameters.

Every position always has a fixed or trailing Take Profit and a fixed Stop Loss set from the beginning. Although the values can be changed, it is recommended to keep the default values which were optimized for a prolonged backtesting period. There will always be a maximum of one open position at a time per symbol, plus any potential recovery trades.

Currency Pairs and Timeframes:

The network was trained to learn the historical market movements of the EURUSD pair. However, you can always test and experiment with other currency pairs. The EA uses the M5 timeframe internally, but you can attach it to any timeframe chart and it will always be working in the same way.

Backtest the Octotrader AI EA from Forex EAs Mall

Octotrader AI Review

The Expert Advisor employs Recurrent Neural Networks, specifically Long Short-Term Memory (LSTM) cells, which are trained using data derived from technical analysis indicators. This approach enables the EA to identify the most relevant indicators for predicting future price movements and to make informed trading decisions accordingly. Additionally, LSTM networks are exceptionally well-suited for time series analysis, as they can effectively analyze both short- and long-term historical data.

Overview

Octotrader AI is an advanced trading solution that blends AI technology with tried-and-tested technical analysis, aiming to give traders a strategic edge in forecasting market moves. Its unique approach combines a dynamic trading strategy with innovative risk management, positioning it as an attractive choice for both retail and prop firm traders. Here’s an in-depth look at what makes Octotrader AI stand out:

Key Features

- AI-Driven Market Predictions

With its integration of Artificial Intelligence, Octotrader AI goes beyond basic analysis, enabling more nuanced market forecasts. This AI-backed insight helps the algorithm quickly adapt to changing market conditions, offering traders real-time responses to price movements. - Innovative Recovery Mode

One of Octotrader AI’s signature features is its recovery mode, which divides each entry into smaller trades. This incremental closing system is designed to secure profits on each successful trade, potentially increasing earnings while minimizing risk on each trade segment. - Flexible Trade Management

The platform’s trading strategy is highly adaptive, automatically adjusting to the trader’s account size, which is especially useful for those trading with prop firms. Octotrader AI offers settings that align with prop firm rules, allowing users to maximize capital efficiency without overstepping risk thresholds. - Advanced Risk Controls

Octotrader AI emphasizes security, with built-in drawdown limiters and customizable risk management tools that let traders control exposure with precision. This focus on safety allows users to protect their capital, even in volatile markets. - Prop Firm Compliance

Octotrader AI has configurations designed specifically for prop firm traders, providing options that align with common risk limits and offering a tailored approach to capital management.

Pros and Cons

Pros:

- AI-enhanced forecasting and adaptability

- Innovative trade recovery system to secure incremental profits

- Customizable risk settings and drawdown controls for enhanced safety

- Configurations compatible with prop firm requirements

Cons:

- Requires understanding of AI-based trading for optimal setup

- Works best with a VPS for stability

Final Verdict

Octotrader AI offers a sophisticated solution for traders looking to incorporate AI into their strategies. With its unique recovery mode and risk management systems, it prioritizes safety and adaptability, making it a strong option for retail and prop firm traders alike. While it may require some initial setup, its features are designed to optimize both security and profitability, making it a valuable tool for serious traders.

Instead of opening just a single trade, this EA will open multiple smaller trades at the same time. If the market changes and the position becomes a loss, the EA will gradually close the losing positions with the profits gained from additional trades.

The EA includes powerful risk management features, including maximum drawdown limits for both the account and daily trading activity, ensuring you stay within your desired risk parameters.

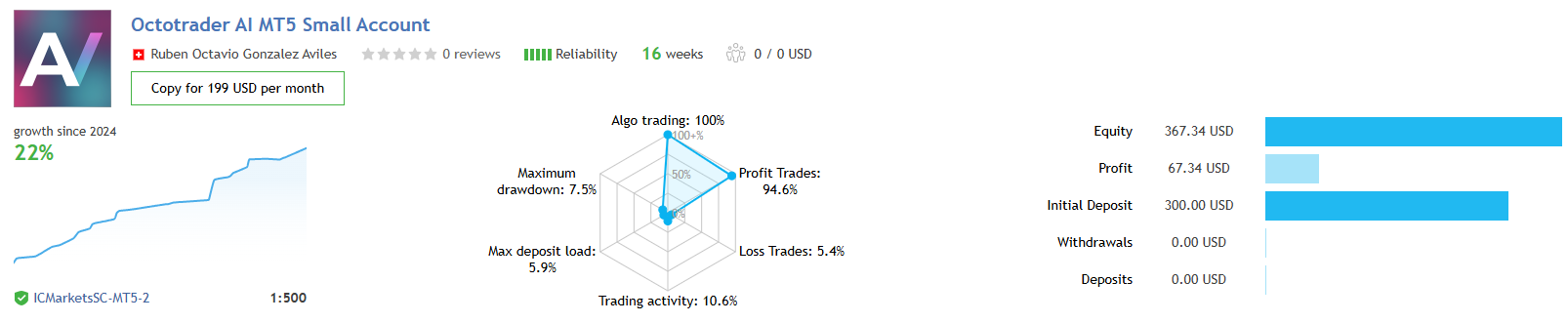

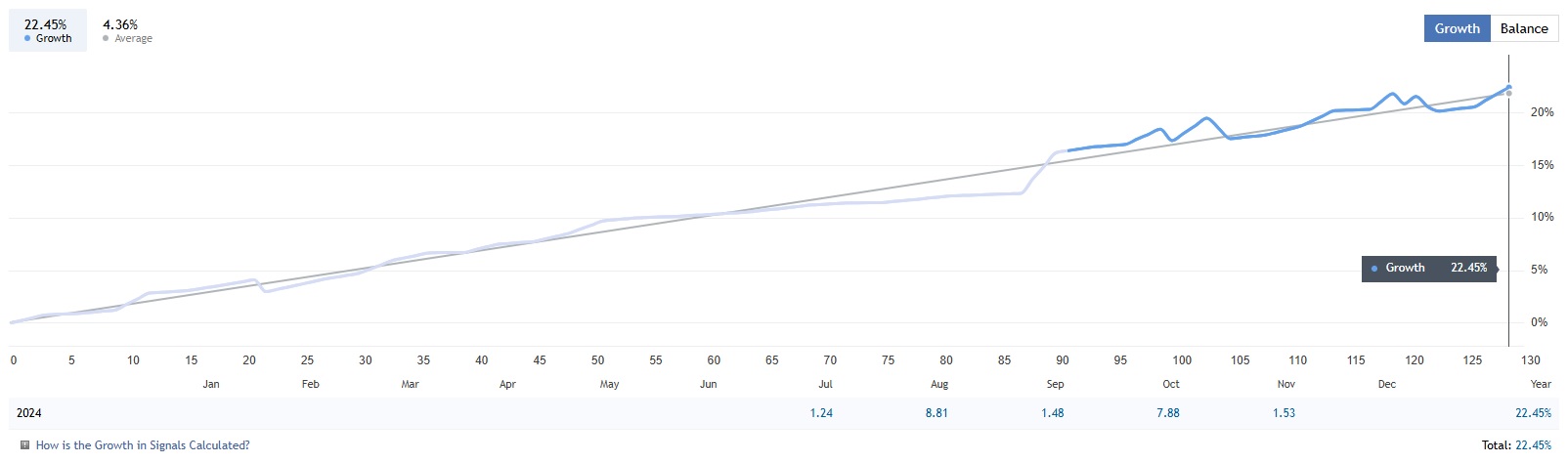

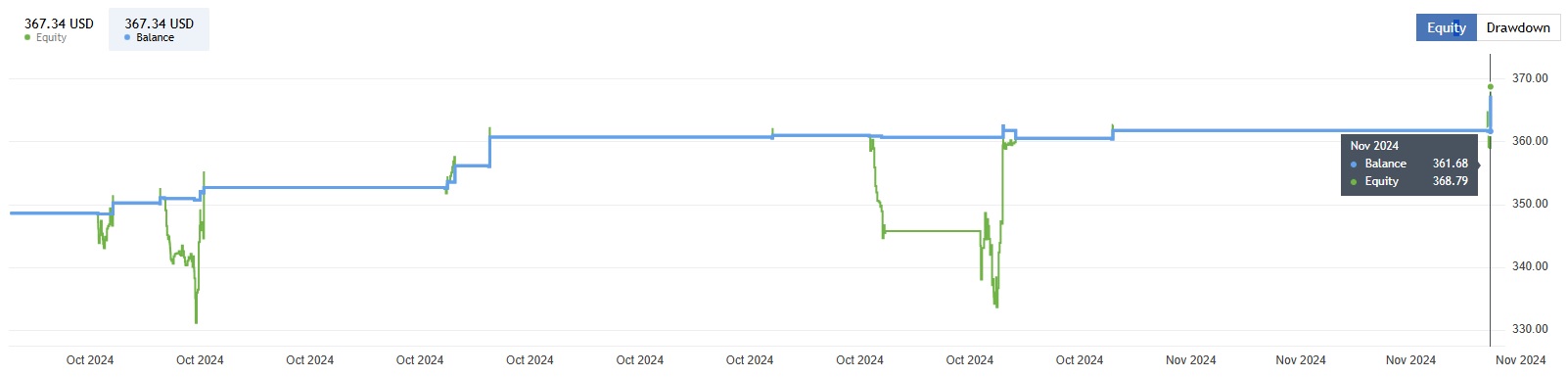

Expert Advisor on ICMarketsSC account 1:500 profit 20%

Signal EA link: Click to view

Recommended Settings for Octotrader AI

Here are some recommended settings to optimize Octotrader AI’s performance on MetaTrader 4. Remember to adjust them according to your trading goals, risk tolerance, and account size:

1. Account Size Adjustment

- Minimum Deposit: $1000 is recommended for a standard account, though Octotrader AI can work with as little as $300 if using a cent account.

- Lot Size: Start with a conservative lot size, such as 0.01 per $1000 of equity. This allows for safe, gradual trading and helps manage risk effectively.

2. Risk Management Settings

- Risk Level: Set risk level to low or medium (e.g., 1-2% per trade). This balances profitability with drawdown control, especially beneficial in volatile markets.

- Drawdown Limit: Use Octotrader AI’s drawdown limiter to set a maximum drawdown percentage (e.g., 10-15%). This feature is essential for protecting your capital and staying within prop firm risk limits.

- Stop Loss: Ensure that the Stop Loss is enabled and is set according to market conditions, usually between 20-50 pips depending on the trading pair and time frame.

3. Recovery Mode Settings

- Trade Splitting: Octotrader AI’s recovery mode divides trades into smaller segments to manage risk. Set the number of segments between 3-5, depending on the account size and market volatility.

- Sequential Closing: Enable sequential closing of trade segments to lock in profits incrementally as they reach target levels.

4. Prop Firm Compliance Settings

- Daily Risk Limit: Set a daily risk limit (e.g., 2-3% of account balance) to align with prop firm requirements. This allows Octotrader AI to operate within safe boundaries.

- Max Trades per Day: Limit the number of trades per day to 5-10 for controlled exposure and to avoid overtrading, which can be critical for passing prop firm assessments.

5. Time Frame and Pair Selection

- Suggested Time Frame: Octotrader AI often performs well on the M5 (5 minutes) time frame, balancing the need for signal accuracy and adaptability.

- Currency Pairs: Focus on major pairs (e.g., EUR/USD) where Octotrader AI’s algorithms are usually optimized. Avoid high-volatility pairs unless specifically configured for them.

6. Auto Optimization and Updates

- Auto-Optimization: If available, enable auto-optimization to adjust the bot’s parameters based on real-time market data.

- Regular Updates: Check for updates from the Octotrader AI provider to keep the algorithm optimized for changing market conditions.

7. VPS for Stable Operation

- Use a VPS: Running Octotrader AI on a VPS ensures continuous operation, minimizes latency, and helps avoid interruptions that could impact trade execution.

8. Testing on a Demo Account

- Demo Testing: Test these settings on a demo account to see how Octotrader AI performs in current market conditions. This is a risk-free way to validate your configuration.

These settings offer a solid starting point, but they may need adjustments depending on market conditions or trading requirements. Remember to monitor Octotrader AI’s performance regularly and adjust parameters as needed.

How to install and run the Octotrader AI Trading Bot in Metatrader 4?

1. Download the Octotrader AI Files

- After purchasing or downloading Octotrader AI, locate the

.ex4or.mq4files, which are the main bot files for MetaTrader 4.

2. Open MetaTrader 4 and Access the Data Folder

- Launch MetaTrader 4 on your computer.

- Go to File > Open Data Folder. This will open the directory where all MetaTrader 4 files are stored.

3. Install the Octotrader AI Bot

- Inside the Data Folder, navigate to

MQL4>Experts. - Copy the

.ex4or.mq4file(s) for Octotrader AI into theExpertsfolder. - Return to MetaTrader 4 and refresh the Navigator panel by right-clicking on the Expert Advisors section and selecting Refresh. Alternatively, you can restart MetaTrader 4 to see the new bot in the Expert Advisors list.

4. Add Octotrader AI to a Chart

- Select the currency pair and time frame that you wish to use with Octotrader AI. Open a chart for this currency pair by navigating to File > New Chart and choosing the desired pair.

- In the Navigator panel, go to Expert Advisors and find Octotrader AI.

- Drag the Octotrader AI bot onto the chart or right-click it and select Attach to Chart.

5. Configure Settings for Octotrader AI

- After attaching the bot to the chart, a settings window will pop up. Here, you can adjust parameters like risk level, account size, and any other custom settings that Octotrader AI offers.

- Set parameters according to your preferred trading style, account size, and any risk management settings required by the bot.

6. Enable Automated Trading

- In the MetaTrader 4 toolbar, ensure that AutoTrading is enabled. You can do this by clicking the AutoTrading button, which should turn green when active.

- Check that a smiley face icon appears in the top right corner of the chart where Octotrader AI is attached, indicating that it’s active and running.

7. Monitor and Manage the Bot’s Activity

- Once Octotrader AI is running, it will start analyzing the market and executing trades based on its programmed strategy.

- You can monitor trade performance and settings in the Expert Advisors tab and adjust parameters as needed.

- Regularly check for updates from Octotrader AI’s developer to ensure optimal performance and stay aligned with any market changes.

Tips for Optimal Performance

- Use a VPS: Running MetaTrader 4 on a Virtual Private Server (VPS) helps to ensure uninterrupted trading, even if your computer is off.

- Test with a Demo Account: Before trading live, try Octotrader AI on a demo account to familiarize yourself with its operation and risk management settings.

Following these steps will help you get Octotrader AI installed and running effectively on MetaTrader 4. Enjoy trading with enhanced AI-powered precision!

If you encounter any problems or need detailed instructions, please refer to the documentation provided with the Octotrader AI or contact us directly for the fastest support.

Ctrl + O => Expert Advisors => Add the link to the Allow WebRequest for listed URL box

https:// api.algovault.net/ (delete space)

Input Parameters

Prop Firm Settings

- Drawdown Limiter: Activate or deactivate the drawdown limiter to control account and daily drawdown limits.

- Initial Account Size: Sets the initial account size for drawdown calculations.

- Max Account Drawdown: Defines the maximum permissible account drawdown as a percentage of the initial account size.

- Max Daily Drawdown: Defines the maximum permissible daily drawdown as a percentage of the initial account size.

Lot Sizes

- Lot Calculation Method: Choose whether to calculate the lot size based on Balance, Equity, or a Fixed Lot Size.

- Fixed Lot Size: Sets the lot size for trades when using fixed lot sizing.

- Max Risk Percentage: Defines the maximum risk for the initial trade batch as a percentage of the account balance or equity.

Batch Settings

- Number of Trades per Batch: The number of trades to be opened for each entry in a batch.

Trade Settings

- Take Profit Type: Sets the type of Take Profit method to either fixed or trailing.

- Take Profit (pips): Sets the Take Profit value in pips.

- Trailing Take Profit (pips): When the initial Take Profit is hit, a trailing stop is set at this value to secure gains.

- Stop Loss (pips): Sets the Stop Loss value in pips.

- Max Spread (points): Sets the maximum spread at which a trade will be executed. If the current spread exceeds this value, no trade will be opened.

Recovery Settings

- Max Recovery Batches: Defines the maximum number of recovery trade batches that will be executed to recover losing trades.

- Recovery Trades Distance (pips): Sets the distance in pips between recovery trades.

- Percentage of Profits used for Recovery: Defines how much of the profits should be allocated for recovering losing trades.

- Recovery Lot Multiplier: Sets the multiplier for lot sizes of recovery trades.

News Filter Settings

- News Filter: Activates or deactivates the News Filter to prevent trading during high-impact news events.

- Event Impact to Filter: Specifies the minimum level of event impact (low, medium, high) to be filtered.

- Filter Trades n Minutes before Event: Prevents trades from being opened within the specified number of minutes before a news event.

- Filter Trades n Minutes after Event: Prevents trades from being opened within the specified number of minutes after a news event.

General Settings

- Magic Number: A unique identifier for the EA, used to differentiate trades when running multiple instances of the EA.

- Trade Comment: A comment attached to each trade executed by the EA.

- User Interface: Toggles the display of the EA’s user interface on the chart.

- User Interface Font Size: Sets the font size of the user interface displayed on the chart.

Recovery Mode – With recovery mode, you can attempt to recover a losing position automatically by opening additional trades to gradually close losing positions one-by-one with the profits. This method is based on the Fibonacci Retracement theory.

Trailing Profit Mode – With a trailing profit mode, you might be able to take advantage of large price movements in a favourable direction. This can also be used in conjunction with the recovery mode.

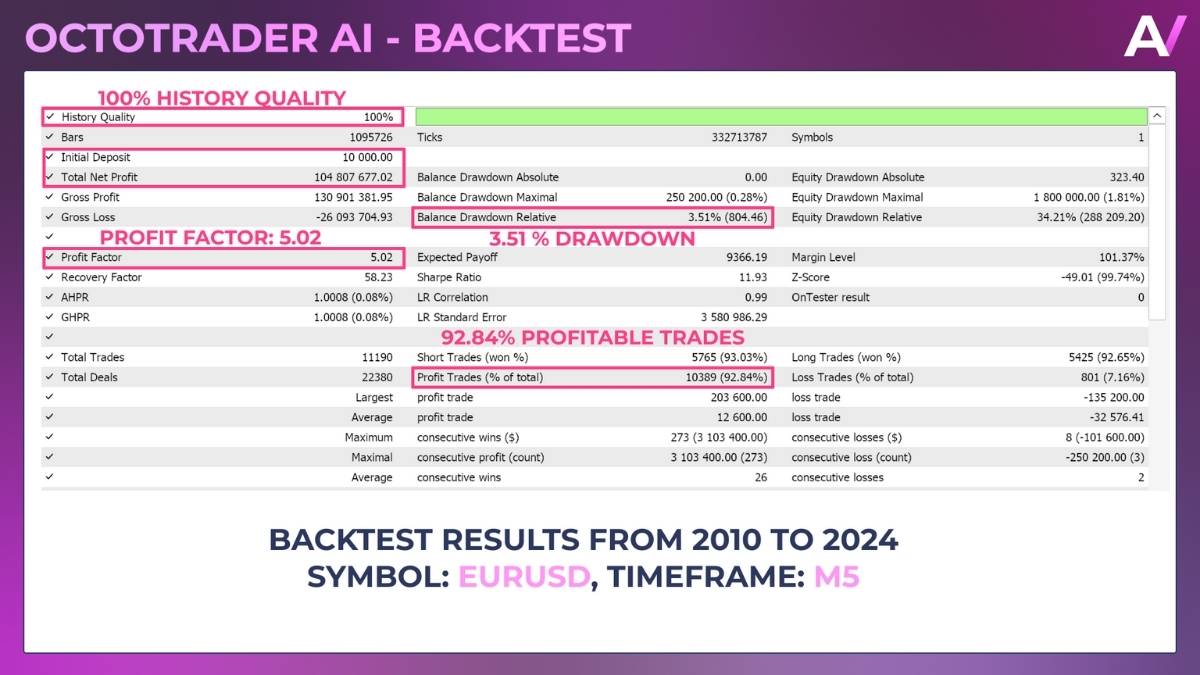

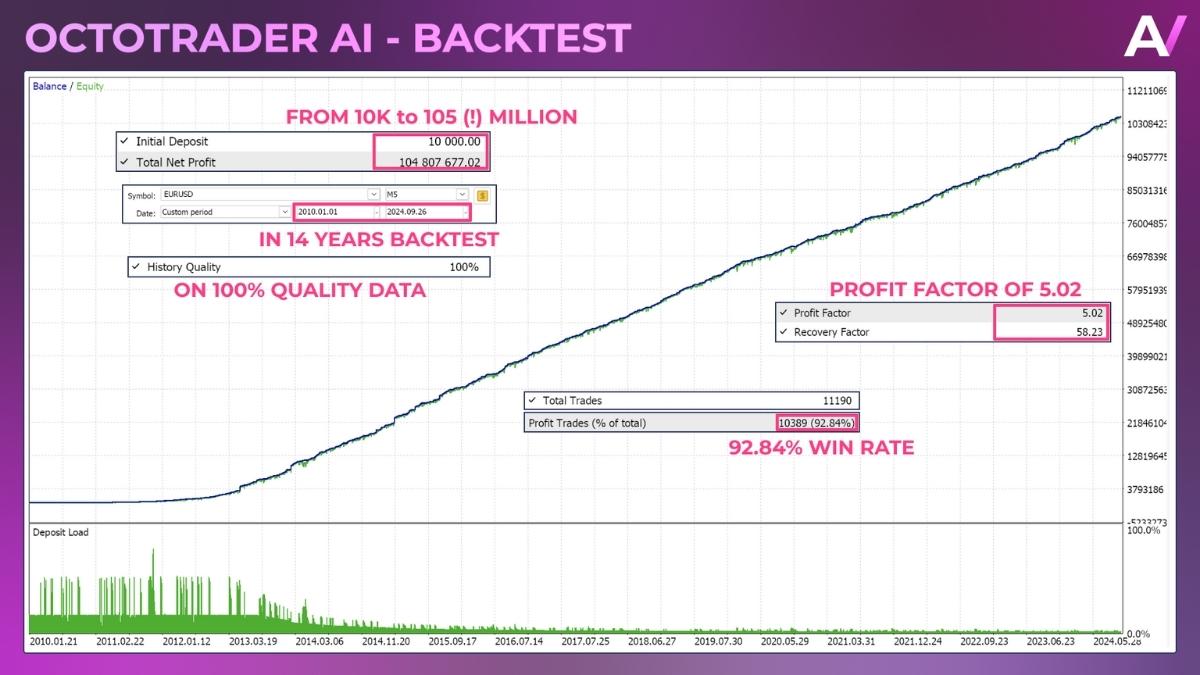

Backtest

During the development, this Neural Network was trained and tested for the backtesting period between 01.01.2010 and 31.12.2023 on 100% history quality data. Additionally, the EA was forward-tested until September 2024.

Octotrader AI Download

Link download Octotrader AI v1.0 MT4 NoDLL will be sent to your email after purchase.

+ Expert :

- Octotrader AI v1.0.ex4

- Unlimited / NoDLL / Build New

- Free 1 Year Updates

Payment

PayPal, Card: Our website checkout system automated.

Memo: Your email + EA name

EA will be send to your email ASAP.

More payment methods please contact us.

You can learn more about other EAs at: Forex Eas Mall

Please read and agree to our terms and conditions and policies before ordering.

Check EA on Demo Account:

- The product does not guarantee profits and demands resilience, patience, and a positive attitude in forex trading.

- Before use, please test the EA on a demo account first.

- Profits are not guaranteed, and for success, risk management, emotional control, and a steadfast attitude are crucial.

Please test in a demo account first for at least a week. Also, familiarize yourself with and understand how this EA works, then only use it in a real account.

Shipping and Delievery:

The product download link will be sent to your email ASAP. No physical products will be sent to your home.

- 95% EAs is instant delivery:

- The download link will be sent to your email within 5 minutes after the order is confirmed.

- 5% Need to wait a bit to receive:

- Some EAs will need to wait a few hours to up to 12 hours to receive the download link.

Thank you for visiting and shopping!

✈️ We will provide the fastest support through our Telegram Channel: Forex EAs Mall