What is Forex Trading?

Let’s take a closer look at everything you need to know about Forex, including what Forex is, how trading works, and how leverage in Forex operates.

1. What is Forex Trading?

Forex trading, also known as foreign exchange trading or FX trading, involves converting one currency into another. FX is one of the most actively traded markets in the world, with individuals, companies, and banks conducting about $6.6 trillion in forex transactions every day.

While many forex transactions are conducted for practical reasons, a significant portion of currency conversion is done by forex traders to profit. The large volume of currency being exchanged daily can lead to extreme volatility in the price of some currencies – something to be mindful of before you start trading forex.

A Beginner’s Guide to Forex: Learn to Trade Currency in 6 Steps

What are Forex Currency Pairs?

A forex pair is the combination of two currencies traded against each other. There are hundreds of different combinations to choose from, but some of the most popular include the euro against the US dollar (EUR/USD), the US dollar against the Japanese yen (USD/JPY), and the British pound against the US dollar (GBP/USD).

What are Base Currency and Quote Currency?

The base currency is always on the left of a currency pair, and the quote is always on the right. The base currency is always equal to one, and the quote currency equals the current price of the currency pair – indicating how much of the quote currency is needed to buy one of the base currencies. Therefore, when you trade currencies, you’re always selling one currency to buy another.

What is a Pip in Forex?

A pip in forex is typically a one-digit movement in the fourth decimal place of a currency pair. For example, if GBP/USD moves from $1.35361 to $1.35371, it has moved by one pip. However, if you’re trading a yen cross, a pip is a change in the second decimal place. A price movement in the fifth decimal place in forex trading is known as a pipette.

2. How Does Forex Trading Work?

Forex trading works like any other transaction in which you buy an asset using a specific currency. In forex, the market price tells the trader how much of one currency is needed to purchase another. For example, the current market price of the GBP/USD currency pair tells you how many US dollars are required to buy one pound.

Each currency has its code, allowing traders to quickly identify which currency is part of a pair. We’ve included the codes for some of the most common currencies below.

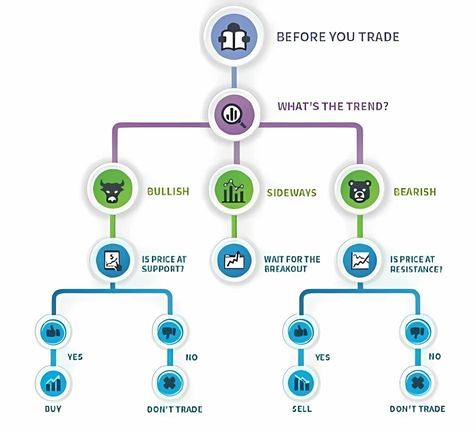

What Does It Mean to Buy or Sell a Currency Pair?

Buying a currency pair means you expect the price to rise, indicating the base currency is strengthening against the quote currency. Selling a currency pair means you expect the price to fall, which would occur if the base currency weakens against the quote currency.

For example, you would ‘buy’ the GBP/USD pair if you think the British pound will strengthen against the dollar – meaning you will need more dollars to buy one British pound. Alternatively, you would ‘sell’ this currency pair if you think the British pound will weaken against the dollar – meaning fewer dollars are required to buy one British pound.

What is the Spread in Forex Trading?

The spread in forex trading is the difference between the buy and sell price. For example, the buy price might be 1.3428, and the sell price might be 1.3424. For your position to be profitable, the market price must rise higher than the buy price or fall lower than the sell price – depending on whether you bought or sold.

What are Margin and Leverage in Forex Trading?

Margin is the initial deposit you must commit to open and maintain a leveraged position. For example, a trade on EUR/USD may require a margin of just 0.50% to open. Therefore, instead of needing $100,000 to open a position, you would only need to deposit $500.

3. Why Do People Trade Forex?

Taking a View on Currency Strength

Traders speculate on currency pairs to profit from one currency strengthening or weakening against another. When the price of a currency pair rises, it means the base is strengthening against the quote, and when it falls, the base is weakening against the quote.

Since a rising price means more quote currency is required to buy one unit of the base, and a falling price means less quote currency is needed, traders might go long (buy) if they expect the base to strengthen or short (sell) if they expect the base to weaken.

Some of the most popular forex trading styles are scalping, day trading, swing trading, and position trading. You can choose a different style depending on whether you have a short-term or long-term outlook.

Hedging Risks with Forex

Hedging is a way to reduce your risk by opening positions that could profit if some of your other positions lose value – with the aim that gains will at least partially offset losses. Currency correlations are an effective way to hedge forex risk. An example is EUR/USD and GBP/USD, which have a positive correlation as they tend to move in the same direction. So, you might short GBP/USD if you have a long position on EUR/USD to hedge against market downturns.

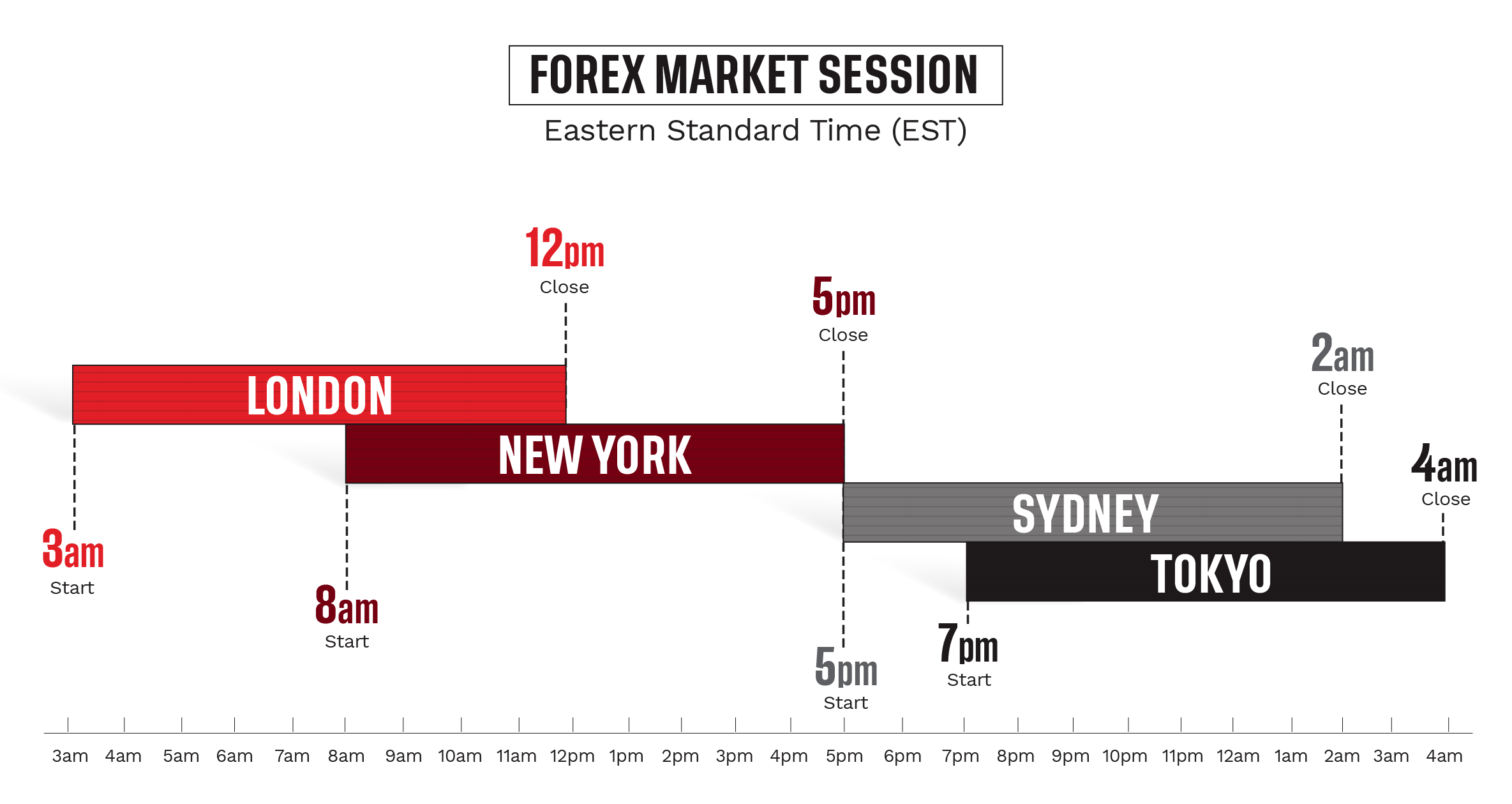

Seizing Opportunities 24 Hours a Day

The forex market is open 24 hours a day thanks to the global network of banks and market makers constantly exchanging currencies. The main trading sessions are in the US, Europe, and Asia, and the time zone differences between these locations allow the forex market to be open 24 hours a day.

Forex trading hours are extremely attractive, giving you the ability to seize opportunities around the clock. We are also the only provider offering weekend trading on certain currency pairs, including GBP/USD, EUR/USD, and USD/JPY on the weekend. This means you can trade these combinations when others cannot.

4. Learn How the Currency Market Works

What Affects the Forex Market?

The forex market consists of currencies from all over the world, which can make it difficult to predict exchange rates because many forces can influence price movements. However, the following factors can all affect the forex market:

Central Bank The supply of a currency is controlled by central banks, which can announce measures that have a significant effect on the price of that currency. For example, quantitative easing involves pumping more money into the economy and could lead to a currency’s price dropping as its supply increases.

News Reports Commercial banks and other investors tend to want to place their capital in economies that have strong prospects. So, if positive news hits the markets about a particular region, it will encourage investment and increase demand for that region’s currency. If negative news hits, demand may fall. This is why currencies tend to reflect the reported economic health of the region they represent.

Market Sentiment Market sentiment, which often reacts to the news, can also play a major role in driving currency prices. If traders believe a currency is headed in a particular direction, they will trade accordingly and may convince others to follow suit, increasing or decreasing demand.

5. How to Become a

How to Become a Forex Trader

There are various ways to trade forex, including spot forex, forex futures, and currency options. When you trade with us, you’ll speculate on spot forex, futures, and options price movements using a CFD account.

- Spot Forex Trading allows you to trade currency pairs at their current market price without a set expiration date.

- Forex Futures or currency futures allow you to trade currency pairs at a specific price for settlement on a set date or within a future range of dates.

- Forex Options or currency options allow you to trade contracts that give the holder the right, but not the obligation, to buy or sell a currency pair at a set price if it exceeds that price within a fixed timeframe.

All these – spot, futures, and options – can be traded with FX CFDs, which are financial derivatives allowing you to speculate on prices rising or falling without needing to own the underlying asset.