Weekly Pairs in Focus – December 29, 2024

Welcome to this week’s comprehensive analysis of key trading pairs and assets. In this article, we explore the latest trends, insights, and predictions for Gold, EUR/USD, GBP/USD, BTC/USD, Silver, DAX, USD/MXN, and NASDAQ 100. Whether you’re a seasoned trader or new to the market, our breakdown will help you stay informed and make better trading decisions.

Gold Analysis

Gold markets attempted a rally this past week but struggled to sustain gains due to persistent concerns over rising interest rates. However, a significant uptrend line lies just below the current price, potentially supporting bullish momentum in the short term. While uncertainties loom, the overall trend suggests Gold remains in an uptrend. Traders should watch for a bounce from this trendline as a potential entry point.

Key Levels:

- Support: $1,880

- Resistance: $1,930

Outlook: Bullish in the short term, provided the trendline holds.

EUR/USD Analysis

The EUR/USD pair experienced a choppy week, hovering just above the crucial 1.03 support level. The holiday season’s reduced liquidity amplified the range-bound movement. A breakdown below 1.03 could trigger a steep decline, while resistance at 1.06 caps upward potential.

Key Levels:

- Support: 1.03

- Resistance: 1.06

Outlook: Neutral, with sideways movement likely between 1.03 and 1.06 in the coming weeks.

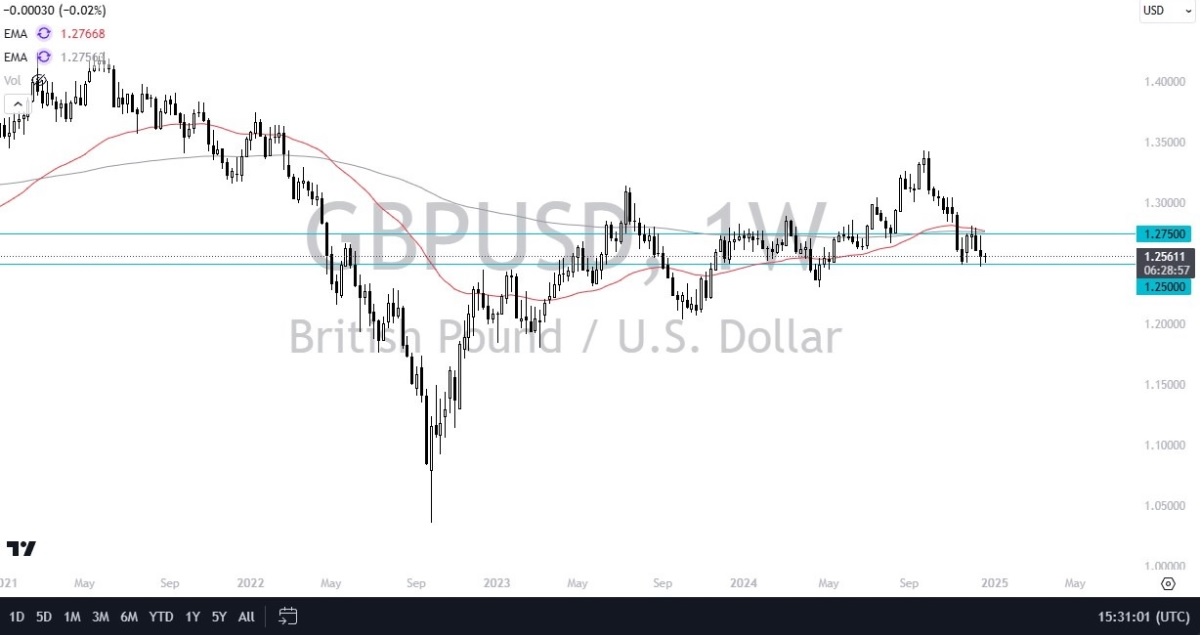

GBP/USD Analysis

The British pound edged lower to test the 1.25 level before rebounding slightly. Market activity remained subdued due to holiday trading. Significant resistance looms near 1.2750, with the 200-week EMA and 50-week EMA reinforcing this barrier. Expect continued sideways action in the near term.

Key Levels:

- Support: 1.25

- Resistance: 1.2750

Outlook: Neutral, with a focus on range-bound trading.

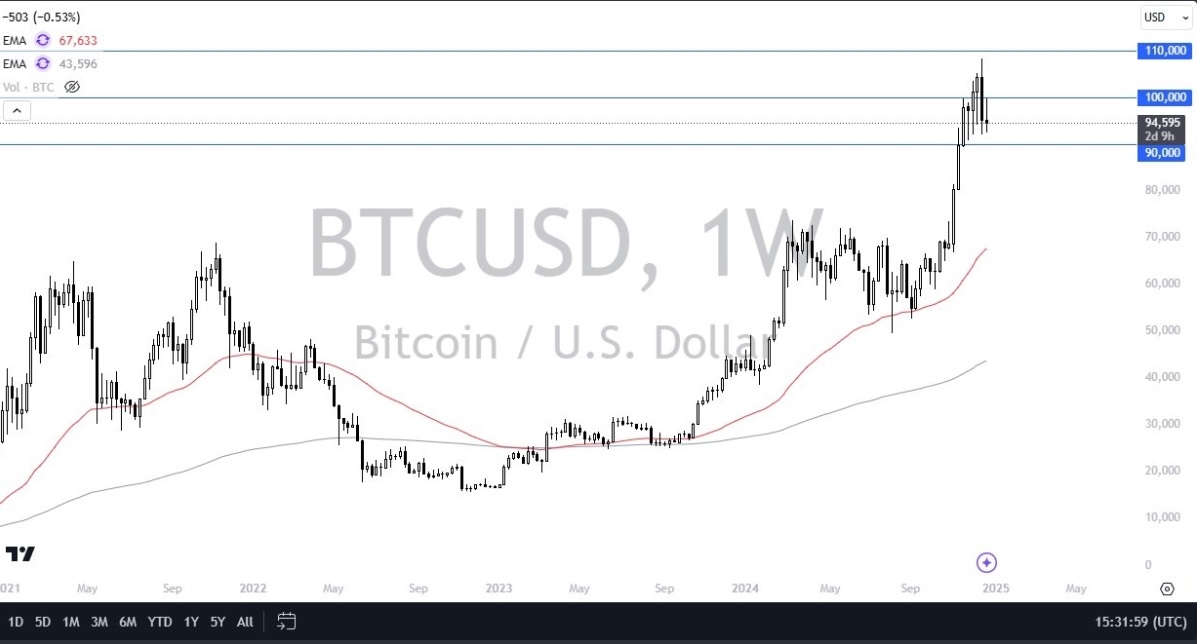

BTC/USD (Bitcoin) Analysis

Bitcoin tried to break the $100,000 level but failed to sustain the momentum, resulting in a weak candlestick formation. Support near $90,000 could stabilize the market, though a break below $80,000 might open opportunities to buy around $74,000.

Key Levels:

- Support: $90,000

- Resistance: $100,000

Outlook: Sideways, with a focus on key support levels.

Silver Analysis

Silver remains under pressure despite a brief rally attempt. The $30 level has proven to be a formidable resistance, while the 50-week EMA provides support. A break below this EMA could lead to declines toward $26 or even $25. Higher U.S. interest rates continue to weigh on silver’s outlook.

Key Levels:

- Support: $26

- Resistance: $30

Outlook: Bearish unless the $30 level is decisively broken.

DAX Analysis

The German DAX index saw minimal movement this week due to holiday closures. The €19,750 level remains a pivotal support zone. A bounce from this level could target €20,500, while a breakdown may drive prices toward €19,000.

Key Levels:

- Support: €19,750

- Resistance: €20,500

Outlook: Neutral, with potential for directional movement as trading resumes.

USD/MXN Analysis

The US dollar gained against the Mexican peso, holding its weekly gains for the first time in several weeks. Consolidation between 20.00 and 21.00 pesos is likely in the near term. Political developments, including potential tariff discussions, could introduce volatility.

Key Levels:

- Support: 20.00 pesos

- Resistance: 21.00 pesos

Outlook: Bullish within the current range.

NASDAQ 100 Analysis

The NASDAQ 100 struggled to overcome the 22,000 level this week, with holiday trading keeping activity subdued. Support at 21,000 remains critical, while a break below this could target 20,000. Expect sideways movement in the short term.

Key Levels:

- Support: 21,000

- Resistance: 22,000

Outlook: Neutral, with a focus on major support and resistance zones.

Conclusion

As we wrap up 2024, market participants should stay vigilant of key support and resistance levels across these assets. Holiday trading conditions can amplify volatility and cause unexpected price swings. Maintain a disciplined approach, and don’t forget to adjust your strategies as market conditions evolve.

Pro Tip: Bookmark this page and check back weekly for fresh updates and insights on major trading pairs.

For more in-depth analysis and live trading strategies, subscribe to our newsletter and join our trading community. Let’s make 2025 a profitable year together!