Trump Tariff Threats Drive Surge in Trade Shipments: How U.S. Businesses Are Mitigating Risks

In the face of ongoing uncertainty surrounding potential tariff hikes stemming from former President Trump’s trade policies, U.S. businesses have significantly ramped up their import activities. This proactive strategy, termed frontloading, has enabled companies to accelerate shipments from China and other regions, reducing the risks of increased costs and disrupted supply chains.

Key Trends in Frontloading Shipments

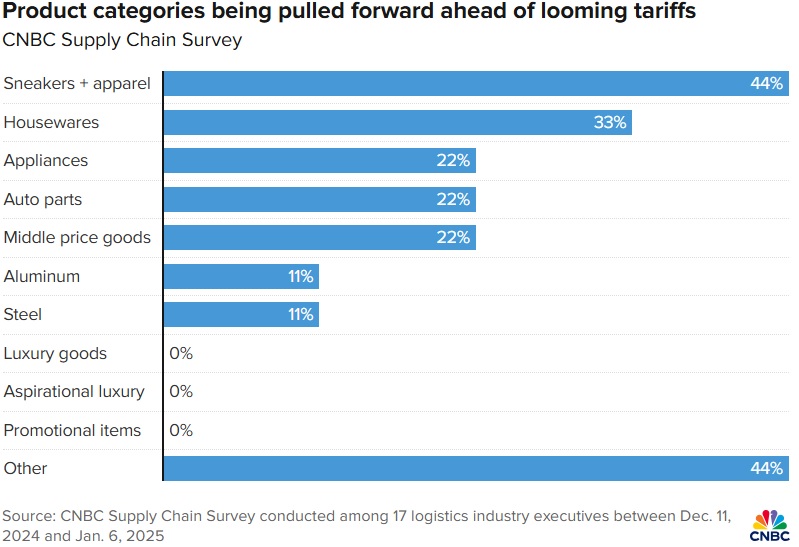

According to a recent CNBC Supply Chain Survey, 78% of shippers have expedited cargo deliveries due to apprehensions about tariffs and potential port disruptions. Industries driving this trend include apparel, electronics, home appliances, and infrastructure components.

The Predominance of Chinese Imports

Chinese exports continue to dominate this movement, with December 2024 marking a notable surge as per official Chinese data. Other regions, including Europe, Vietnam, Malaysia, India, and South America, also contributed significantly. Retail giants like Walmart reported a 33% year-over-year rise in imports originating from China, highlighting the widespread impact.

Reducing Dependence on Chinese Suppliers

To mitigate tariff-related risks, U.S. companies are increasingly diversifying their supply chains. Nations such as Vietnam, Cambodia, India, and Turkey are becoming favored alternatives for sourcing.

“We’re witnessing a strategic transformation in supply chains,” said Paul Brashier, VP of Global Supply Chain at ITS Logistics. “Textiles, clothing, and fabrics are now being sourced from non-Chinese suppliers to avoid potential tariffs.”

Consumer Goods Most Affected by Tariff Impacts

Items being frontloaded include:

- Apparel and footwear

- Home appliances and furnishings

- Auto parts and components

The looming threat of tariff-driven price increases has spurred these preemptive measures. “Tariffs are essentially taxes fueling inflation,” said Stephen Lamar, CEO of the American Apparel & Footwear Association. “The uncertainty creates immense challenges for business planning.”

Infrastructure Projects and Supply Chain Strategies

Infrastructure projects, particularly those involving solar panels and construction materials, have not been exempt from the effects of frontloading. Many companies placed orders months in advance to adhere to budgetary and timeline constraints.

Experts recommend the following strategies to build resilience in supply chains:

- Diversification: Seek alternatives to Chinese suppliers.

- Risk Assessment: Analyze the financial impact of various tariff scenarios.

- Adaptability: Maintain agile supply chain practices to respond to evolving policies.

Ben Bidwell, Director of North America Customs at C.H. Robinson, highlighted the need for collaboration between supply chain and finance teams to brace for tariff changes.

Robust Consumer Demand and Freight Stabilization

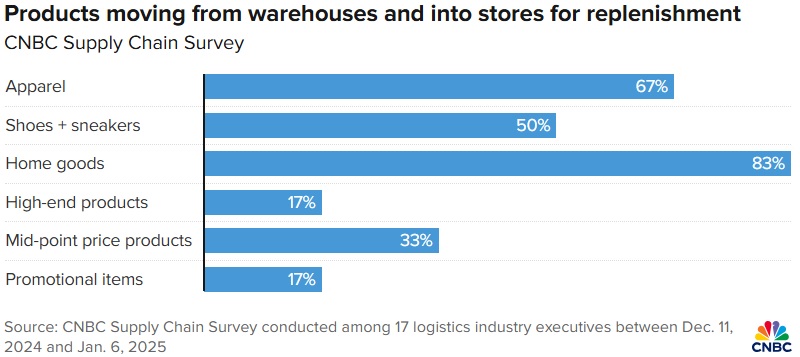

Despite challenges, consumer demand has remained steady, with over 60% of businesses reporting increased freight orders. Mid-priced goods are particularly prominent in the import market, reflecting consistent consumer spending patterns.

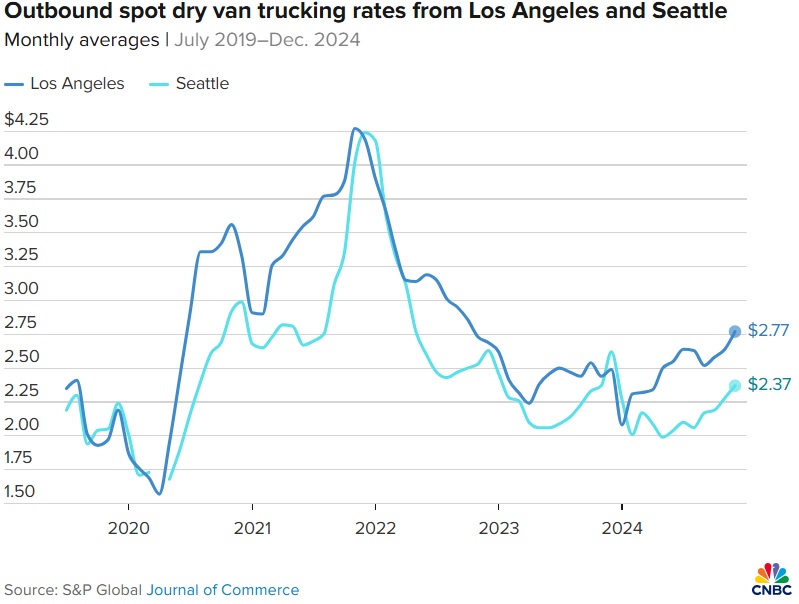

Meanwhile, the freight and trucking industry, recovering from a prolonged recession, shows promising signs of stabilization. In December 2024, freight rates in Los Angeles rose by 5%, reaching a 26-month high. The East Coast market has also remained steady amid tariff-driven activities.

Looking Ahead to 2025

As the U.S. anticipates potential trade policy shifts, businesses are proactively implementing measures to navigate uncertainties. From diversifying suppliers to accelerating shipments, these strategies underscore the importance of adaptability and strategic planning. Maintaining competitiveness in a dynamic global market will be paramount in the years to come.