In a bold move that has reignited debates over international trade, President Donald Trump announced on Monday evening that his administration will impose a 25% tariff on goods imported from Mexico and Canada starting February 1. This decision, unveiled during an Oval Office signing ceremony, represents a dramatic shift in North American trade relations and could have profound implications for the U.S. economy and its consumers.

Economic Context of Mexico and Canada Trade

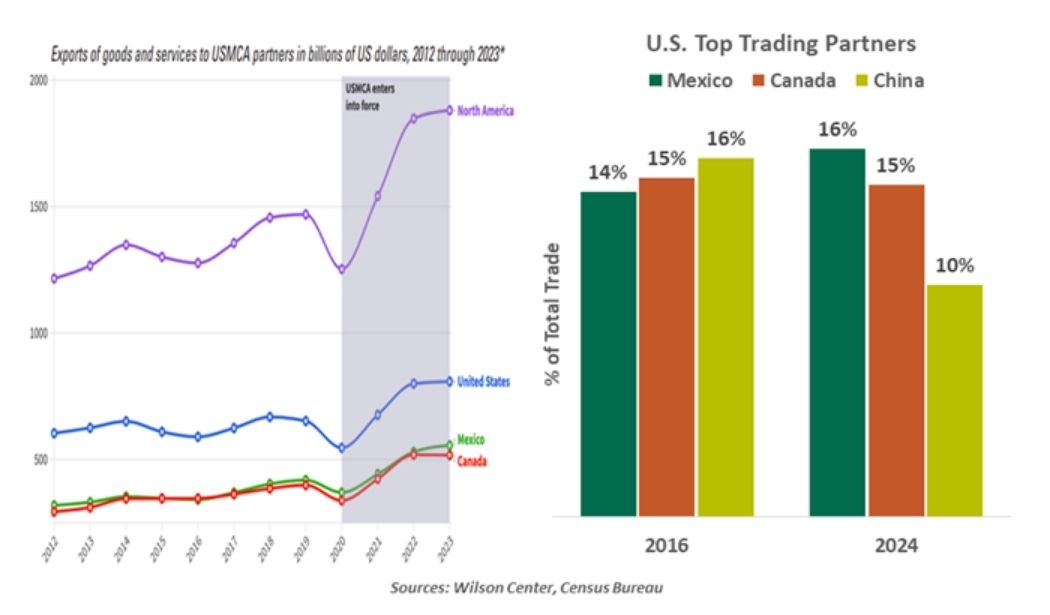

Mexico and Canada are two of the United States’ most significant trading partners, collectively accounting for a substantial portion of U.S. trade. In 2024, the U.S. imported $475 billion worth of goods from Mexico and $418 billion from Canada, representing 30% of all U.S. imports. Meanwhile, exports to these neighbors totaled $676 billion, or one-third of total U.S. exports.

The proposed tariffs are expected to increase the cost of imported goods, ranging from automobiles and agricultural products to consumer electronics. Analysts warn that this move could trigger retaliatory measures from Mexico and Canada, potentially escalating into a trade conflict that harms American businesses reliant on exports.

Reactions from Experts and Think Tanks

Economic experts have been quick to critique the proposed tariffs. Judge Glock, director of research at the Manhattan Institute, referred to the tariffs as a “self-inflicted wound” that could undermine the U.S. economy. Similarly, Clark Packard of the Cato Institute’s Herbert A. Stiefel Center for Trade Policy Studies warned that such tariffs might violate the United States-Mexico-Canada Agreement (USMCA), jeopardizing the credibility of future trade deals.

Trump’s “America First” Trade Agenda

The proposed tariffs align with Trump’s broader “America First” trade philosophy. In his inaugural address, Trump emphasized his intent to overhaul the U.S. trade system, stating, “Instead of taxing our citizens to enrich other countries, we will tariff and tax foreign countries to enrich our citizens.”

Trump’s executive action on Monday also directed government agencies to investigate trade deficits, assess the effectiveness of USMCA, and explore stricter trade policies to address issues such as fentanyl trafficking and undocumented migration. The initiative includes the establishment of an “External Revenue Service” to collect tariff revenue, which Trump claims will generate substantial funds for the U.S. Treasury.

Debate Within the Administration

The decision to implement these tariffs has sparked intense discussions among Trump’s economic advisors. While trade hardliners like Peter Navarro and Howard Lutnick advocate for aggressive tariff policies to assert U.S. dominance, market-oriented officials such as Scott Bessent and Kevin Hassett caution against the economic repercussions. Proposals under consideration include phased tariff increases and delayed implementation to encourage negotiation.

Potential Economic Consequences

Economists widely agree that tariffs are ultimately paid by domestic businesses and consumers. The Peterson Institute for International Economics highlights that higher import taxes would lead to increased prices on goods such as electronics, toys, and food. This could exacerbate inflation, which has already strained American households.

History provides further cautionary tales. During Trump’s first term, retaliatory tariffs from countries like China targeted U.S. exports, including soybeans, automobiles, and whiskey, leading to significant losses for American producers.

Impact on the USMCA

The USMCA, hailed as a landmark trade deal during Trump’s first term, could face challenges if these tariffs are enacted. Potential violations of the agreement’s terms might discourage future trade negotiations with other nations. As Judge Glock observed, “Other countries will be more reluctant to negotiate such deals in the future if they know the deals cannot secure consistent trade relationships.”

Trump’s Long-Term Trade Strategy

Trump’s tariff proposal is part of a larger strategy to leverage trade as a tool for achieving geopolitical and economic objectives. By imposing steep tariffs, Trump aims to compel trade partners to the negotiating table while safeguarding American industries. However, critics argue that such an approach risks alienating allies and destabilizing global markets.

Conclusion: Balancing National Interests and Economic Stability

Trump’s proposed 25% tariffs on Mexico and Canada mark a pivotal moment in U.S. trade policy. While the administration frames the move as a necessary step to protect American workers and industries, the potential economic fallout—from higher consumer prices to strained international relations—cannot be overlooked.

As Trump’s economic team debates the implementation details, the stakes are high. Will the tariffs achieve their intended goals, or will they usher in a new era of trade conflicts and economic uncertainty? Only time will tell, but one thing is clear: the ripple effects of this decision will be felt across borders and industries.

Businesses, policymakers, and consumers alike must prepare for the potential disruptions ahead. In the meantime, the world watches as the United States navigates this controversial chapter in its trade history.

Disclaimer: This article provides an analysis of recent developments in U.S. trade policy and does not reflect the opinions of all stakeholders or authors.