- Gold price sticks to key support level, set for third consecutive weekly gain on Fed rate cut expectations.

- US PPI rises above estimates; University of Michigan Consumer Sentiment drops, inflation expectations moderate.

- CME FedWatch Tool indicates 94% chance of September rate cut; US Dollar Index falls over 0.40% to 104.09.

Gold’s price clung above $2,400 on Friday after hitting a daily low of $2,391. The golden metal is set to extend its gains for the third consecutive week on speculation that the Federal Reserve (Fed) might begin its easing cycle in September. Data from the US Department of Labor showed that factory prices rose above estimates, though they failed to underpin the Greenback, a tailwind for the precious metal.

The XAU/USD trades at $2,415, virtually unchanged. The US Bureau of Labor Statistics on Friday revealed that the Producer Price Index (PPI) jumped modestly in June, above analysts’ estimates. The University of Michigan Consumer Sentiment preliminary July reading deteriorated, but inflation expectations have tempered.

According to the CME FedWatch Tool, traders are pricing a 94% chance that the Fed might cut rates a quarter of a percentage point in September.

Hence, US Treasury bond yields are dropping, a tailwind for the non-yielding metal, which benefits from low yields. The US 10-year Treasury note coupon is yielding 4.19%, two basis points below its opening price.

Sources cited by Barron’s stated, “Inflation is coming down, but it is not going to disappear. Gold and gold miners are attractive inflation hedges.”

Meanwhile, Fed officials have remained cautious regarding monetary policy shifts. Chicago Fed President Goolsbee noted that recent inflation data is “favorable” and could shorten the Fed’s journey toward its inflation goals.

St. Louis Fed President Alberto Musalem stated that the current interest rate level is appropriate for the current conditions and expects the economy to grow between 1.5% and 2% this year.

Meanwhile, the US Dollar Index (DXY), which tracks the Greenback against a basket of six currencies, plummeted more than 0.40% to 104.09.

Daily digest market movers: Gold price flatlines post US PPI

- June US Producer Price Index (PPI) increased by 0.2% MoM, exceeding the expected 0.1% and higher than May’s 0%. Core PPI rose by 0.4% MoM, surpassing the forecast of 0.2%.

- On an annual basis, PPI ticked up from 2.4% to 2.6%, beating the forecast of 2.3%. Underlying inflation increased to 3%, up from 2.6%.

- UoM Consumer Sentiment dropped from 68.2 in June to 66.0 in July. Inflation expectations for one year were as expected at 2.9%, down from 3%.

- US Dollar Index (DXY), which tracks the value of a basket of six currencies against the US Dollar, fell more than 0.30% to 104.12.

- According to the CME FedWatch Tool, the odds of a September rate cut are 88%, up from 85% on Thursday.

- December 2024 fed funds rate futures contract implies that the Fed will ease policy by 49 basis points (bps) toward the end of the year, up from 39 a day ago.

- Bullion prices retreated slightly due to the People’s Bank of China (PBoC) decision to halt gold purchases in June, as it did in May. By the end of June, China held 72.80 million troy ounces of the precious metal.

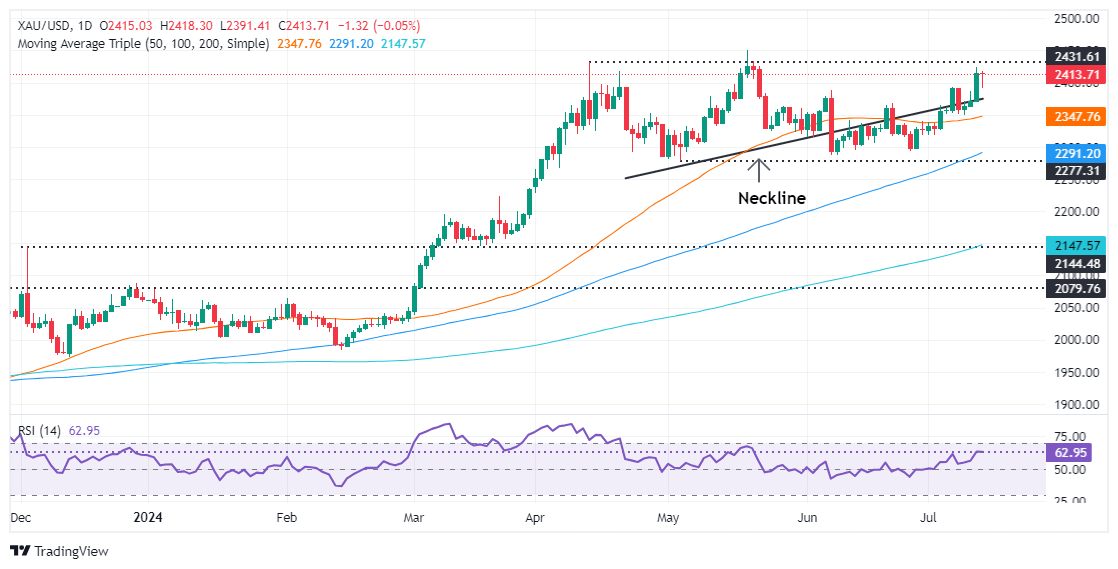

Technical analysis: Gold buyers take a respite, Gold price hovers above $2,400

Gold price consolidates above $2,400 for the second straight day after decisively breaking the Head-and-Shoulders neckline. Momentum favors buyers, though as depicted by the flat Relative Strength Index (RSI), they’re taking a respite before testing higher prices.

That said, the path of least resistance is to the upside. The XAU/USD’s first resistance would be the year-to-date high of $2,450, ahead of the $2,500 mark. Conversely, if Gold slides below the $2,400 figure, the next demand zone will be July 5 high at $2,392. If cleared, XAU/USD would continue to $2,350.

NEWS | | By Christian Borjon Valencia