Key Highlights:

- UK Economic Indicators: Inflation, GDP, and Retail Sales.

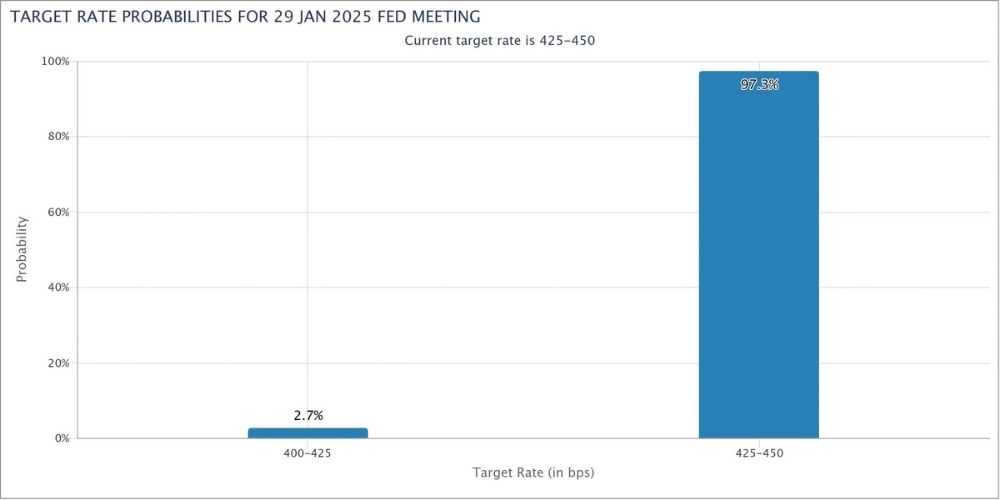

- U.S. CPI Report and Fed Rate Expectations.

- Technical Analysis on GBPUSD (3-Day Time Frame).

Source: CME Fed Watch Tool

Inflation and Monetary Policy Trends in 2025

Inflation worries are shaping the global financial landscape as we enter 2025. Following a robust Non-Farm Payroll (NFP) result in late 2024, which added 256,000 jobs, the Federal Reserve’s likelihood of pausing rate hikes hit 97%. Yet, persistent inflation risks and new U.S. policy directions under the Trump administration have fueled speculation about potential rate increases.

The U.S. Dollar Index (DXY) has surged toward the 110-mark, putting pressure on currencies worldwide. This strength has driven the British Pound (GBP) closer to its October 2023 lows, reinforcing its position within a prolonged 15-year consolidation range.

UK Economic Data to Watch

This week promises significant volatility for GBP/USD traders, as both the U.S. CPI report and a slate of critical UK economic indicators are due for release. Among the most anticipated are:

- UK Inflation Rate: Stabilized at 2.6% for the past eight months.

- Monthly GDP Data: Forecasts range from -0.1% to 0.2%, potentially marking a 3-month high.

- Retail Sales: Expected to impact short-term market sentiment for the pound.

For pound bulls, better-than-expected data could provide a foundation for recovery against the U.S. dollar.

Technical Analysis: GBP/USD 3-Day Chart

Key Levels and Indicators

- Current support: October 2023 low at 1.2030.

- Resistance: Upper boundary of the 15-year consolidation at 1.2770.

- Fibonacci levels:

- 1.272 extension: Drawn from July 2023 high (1.3125), October 2023 low (1.2030), and September 2024 high (1.3434).

- Critical bearish targets: 1.18 and 1.1670, aligned with the 1.5 and 1.618 Fibonacci extensions.

The Relative Strength Index (RSI) indicates oversold conditions similar to October 2023 and September 2022. This suggests the possibility of a short-term bounce, provided the current support holds.

For a bullish reversal, GBP/USD must reclaim levels above the 2024 low at 1.2330, paving the way for a potential climb to 1.2770. On the downside, sustained bearish momentum below 1.20 could lead to further declines, targeting the 1.18 zone.

GBPUSD 2025 Outlook

In the near term, GBP/USD faces increased volatility amid mixed economic data and inflation uncertainties. While downside risks remain prominent, supportive technical conditions may present opportunities for recovery.

Trade Smart: Monitor key levels and macroeconomic data for better risk management and strategic decision-making.

Stay updated with our exclusive GBP/USD Trading Guide for 2025 to navigate these volatile markets effectively.

(Note: This analysis is for informational purposes and not financial advice. Always consult with a professional before making trading decisions.)