As we close out 2024, the Federal Reserve’s delicate balancing act between its dual mandates of employment and price stability continues to take center stage. With inflation showing signs of moderation and the labor market easing from its once-tight grip, the Fed’s next moves could define the economic landscape for 2025. Let’s dive deep into the factors influencing the Fed’s decisions and the broader implications for the economy, markets, and investors.

Fed Grapples With Inflation And Market Volatility What Lies Ahead For 2025

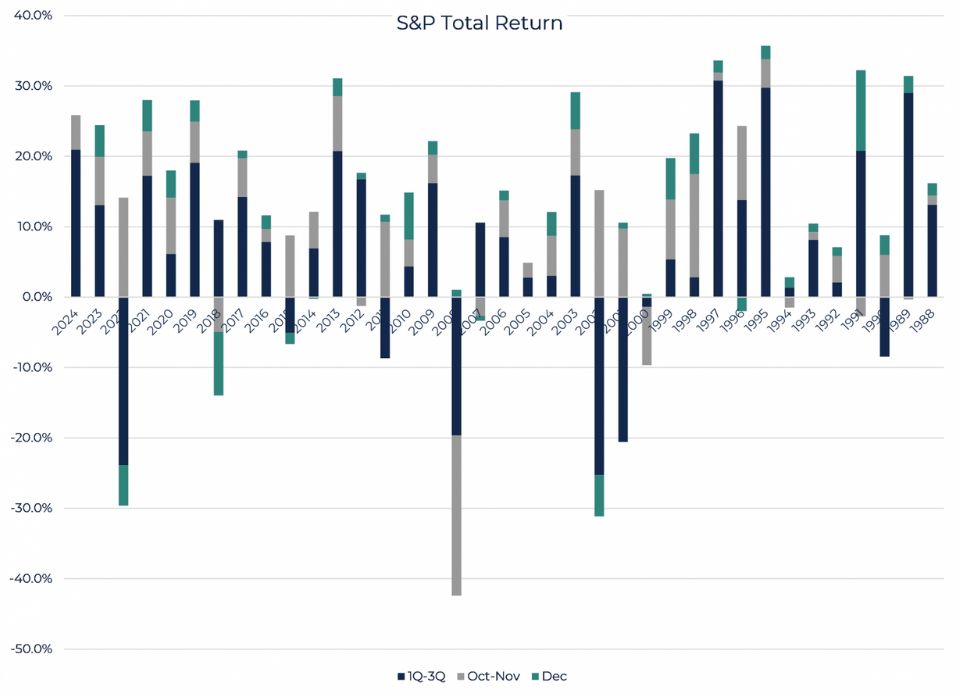

Source: FactSet ; Past performance does not guarantee future returns.

Labor Market: Easing but Resilient

The labor market—one of the Fed’s key indicators—has shown signs of cooling. Average monthly payroll gains have slowed to 173,000, a marked deceleration compared to prior years. Despite this, unemployment remains historically low at 4.2% as of November, albeit slightly higher than last year. Wage growth has also tempered, with the gap between job openings and available workers narrowing considerably.

Fed Chair Jerome Powell summarized the state of the labor market succinctly during his December 18th press conference: “We don’t think we need further cooling in the labor market to get inflation down to 2 percent.” This statement suggests that the Fed sees the employment situation as balanced enough not to exert additional inflationary pressure—a positive signal for 2025.

Inflation: The Core Challenge

Inflation continues to be the primary focus for the Fed. While recent months have shown a mix of moderation and sporadic upticks, the overall trend suggests progress toward the Fed’s 2% target. However, uncertainties remain. For example, the political landscape in Washington—including looming tariff decisions and the risk of a government shutdown—could introduce fresh inflationary pressures.

The Fed’s cautious stance appears prudent, given the lagged effects of monetary policy. While four months of moderated inflation preceded higher readings in September and October, November’s data brought renewed optimism. The coming months will test whether this moderation is sustainable or a temporary reprieve.

Markets: Strength and Sensitivity

December has historically been a strong month for equities, particularly after a robust year. With the S&P 500 nearing record highs, market momentum has been fueled by tax-loss mitigation and expectations of lower tax rates under the current administration. Yet, this strength comes with heightened sensitivity. Powell’s recent remarks—interpreted as hawkish—briefly rattled markets, underscoring the fragility of investor sentiment.

Looking to January 2025, we may see volatility return. The so-called “Santa Claus rally” could give way to reversals in trends that dominated 2024. Investors should brace for potential headwinds as market conditions reset in the new year.

The Fed’s 2025 Outlook: A Divided Committee

The Fed’s intentions for 2025 are far from unanimous. Notably, four members—including three non-voting—preferred to leave rates unchanged in the last meeting. This divergence could signal a more hawkish stance next year, depending on the rotation of voting members within the Federal Open Market Committee (FOMC).

Subtle revisions to economic projections further complicate the picture. By lowering the unemployment estimate by 1 basis point and increasing core inflation projections by 3 basis points, the Fed has effectively lowered the bar for additional rate hikes in 2025. Markets have already digested these signals, but their implications remain a wildcard.

2025 Economic Concerns: The Road Ahead

Several key concerns loom large as we step into 2025:

- Earnings Growth: Estimated year-over-year earnings growth for the S&P 500 stands at +11.8% for Q4 2024, the highest since late 2021. While promising, any slowdown in earnings could weigh heavily on market performance.

- Persistent Inflation: Should inflation fail to decline further or reassert itself, the Fed may have no choice but to resume tightening—a scenario that could ripple across markets and the broader economy.

- Deficits and Yields: Rising deficits could push yields higher, diverting focus from equities to bonds, particularly if inflation remains stubborn.

- Geopolitical Unrest: From trade retaliations to escalating conflicts, global economic growth and stability remain at risk. The implications for inflation, bond yields, and equity performance could be significant.

- Policy Uncertainty: The incoming administration’s fiscal policies and their potential impact on trade, taxation, and government spending will be critical factors to watch.

Key Takeaways for Investors

- Labor Market Resilience: Stable employment metrics offer a cushion against economic shocks.

- Inflation Trends: Monitoring inflation dynamics will be crucial for gauging Fed policy moves.

- Market Volatility: Prepare for potential reversals in early 2025 as the market digests policy and geopolitical developments.

- Global Factors: Geopolitical unrest and international economic trends may significantly impact the U.S. market.

Conclusion: Uncertainty Dominates 2025

As 2025 dawns, the overarching theme is uncertainty. While the Fed’s cautious approach to inflation and employment provides some stability, myriad external factors could disrupt the economic equilibrium. From geopolitical tensions to domestic political developments, the path forward is anything but clear.

For investors, the key lies in adaptability. Diversification, disciplined risk management, and staying informed will be essential strategies in navigating the potential volatility of the new year. With inflation as a pivotal driver, all eyes will remain on the Fed and its ability to steer the economy through uncharted waters