Donald Trump’s Pressure on the USD-Based Financial System and the Risks Involved

Donald Trump is increasing pressure on nations worldwide to maintain a financial system anchored to the US dollar. However, financial experts warn that this strategy could backfire and lead to unintended consequences.

Mark Sobel, a former official with 40 years of experience in currency policy at the US Treasury, believes the US dollar will continue to dominate the global economy in the near future. He dismissed the idea of emerging economies creating a single alternative currency as mere “hot air.”

Yet, Trump’s recent actions may inadvertently encourage countries to seek ways to reduce reliance on the USD, potentially undermining the dollar’s long-term dominance. Brad Setser, a senior fellow at the Council on Foreign Relations and a former US Treasury official, noted that such moves “indirectly elevate the stature of a non-threat and signal a lack of confidence in the dollar.”

Warnings to BRICS Nations

In a recent post on Truth Social, Trump demanded that BRICS nations commit to not creating a shared currency to rival the USD, repeating threats to impose a 100% tariff if they proceed with such plans. While South Africa clarified there are no current plans for a unified currency, Trump’s statements have drawn attention to potential shifts in global trade and financial systems, requiring governments and investors to remain vigilant.

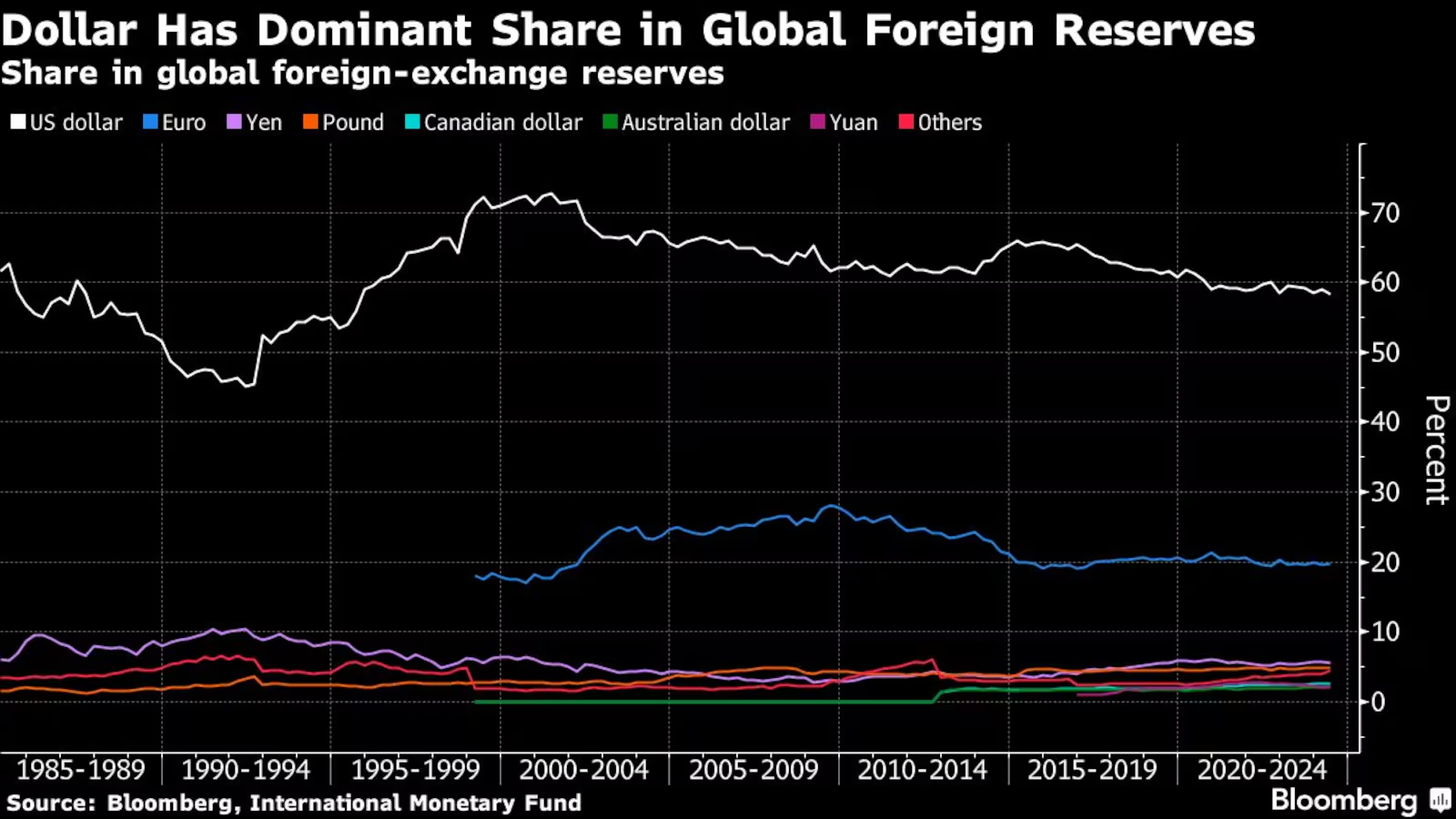

The Dominance of the US Dollar

Despite discussions of alternatives, the USD remains deeply entrenched in the global financial system. According to a 2022 survey by the Bank for International Settlements (BIS), the dollar was involved in 88% of the $7.5 trillion daily forex market transactions.

Rodrigo Catril, a strategist at National Australia Bank, stated, “The USD remains dominant due to its liquidity, free tradeability, and status as the world’s lending currency.” However, he added, “If Trump increases pressure on BRICS, it could accelerate moves away from the dollar.”

Countries Reducing USD Dependence

While no immediate replacement for the USD exists, several nations have already implemented bilateral trade agreements using their local currencies. For example, Brazil and China have established trade in their domestic currencies, India and Malaysia have increased rupee usage for cross-border transactions, and Thailand and China have signed agreements to promote bilateral trade in local currencies.

Ulrich Leuchtmann, head of forex research at Commerzbank AG, commented, “Anyone outside the US using the dollar for transactions might perceive it as a yoke imposed by the US. In the long term, this is not a sustainable situation, especially if US policies become increasingly self-serving.”

Conclusion

While the USD’s global dominance remains unchallenged for now, Trump’s tactics could inadvertently fuel efforts by nations to diversify their financial systems. This suggests that the long-term position of the dollar as the world’s reserve currency might not be as secure as it once was.