Unemployment insurance data is not just a reflection of the labor market but also a vital economic indicator for predicting future economic trends. This week’s report from the U.S. Department of Labor highlights notable figures in unemployment claims and their implications.

I. Key Highlights from the Report

- Initial Claims (Seasonally Adjusted):

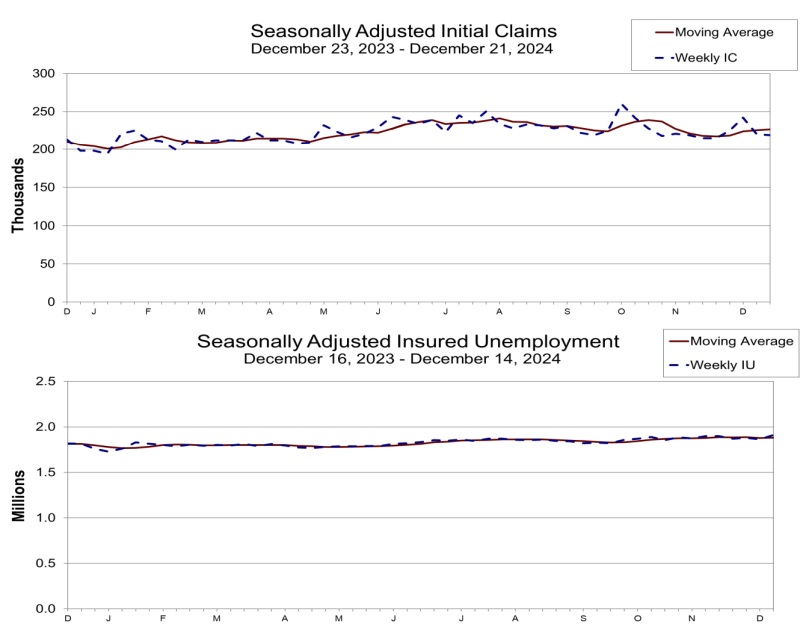

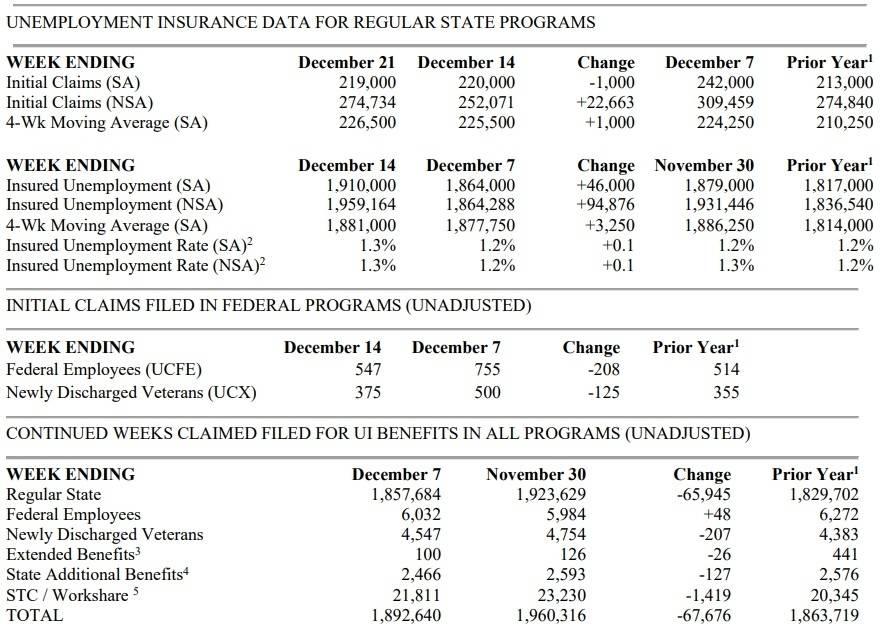

- Total initial claims for unemployment insurance reached 219,000, a slight decrease of 1,000 from the previous week.

- The 4-week moving average increased to 226,500, up by 1,000 from the prior week’s average, showing a mild upward trend.

- Insured Unemployment Rate:

- The insured unemployment rate increased from 1.2% to 1.3%, marking the highest level since November 2021.

- Total insured unemployment claims stood at 1,910,000, up by 46,000 compared to the previous week.

- Unadjusted Data:

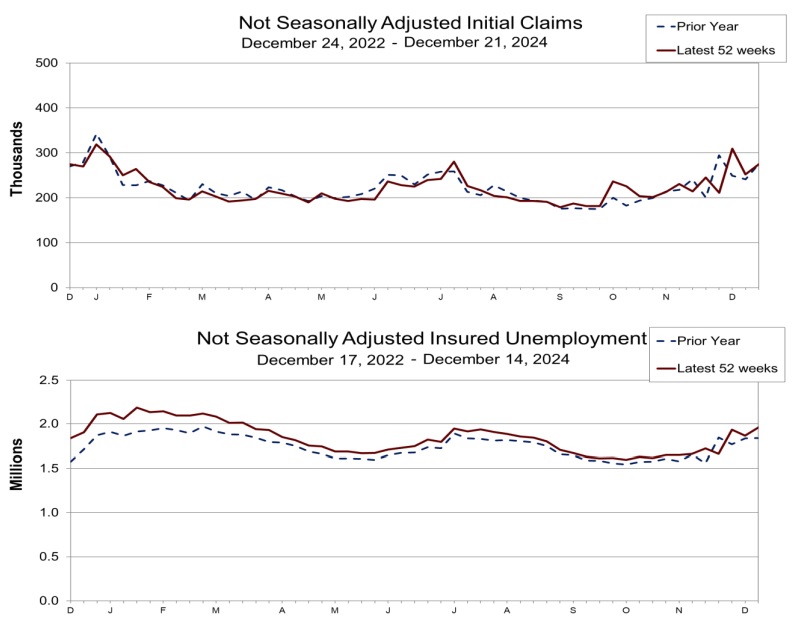

- Unadjusted initial claims reached 274,734, up by 9.0% (or 22,663 claims) from the previous week.

- Insured unemployment under state programs rose to 1,959,164, a 5.1% increase (or 94,876 additional claims).

II. Trends Across U.S. States

The report reveals varying trends among states, highlighting the different economic impacts nationwide:

- States with Significant Declines in Claims:

- New York: Decrease of 6,807 claims, driven by fewer layoffs in transportation, warehousing, and construction.

- Texas: Drop of 5,405 claims, with no specific reasons provided.

- California: Decline of 5,279 claims, reflecting stability across several industries.

- States with Notable Increases in Claims:

- Nebraska: Rise of 392 claims, indicating localized economic pressures.

- Kentucky: Increase of 378 claims, likely tied to fluctuations in manufacturing sectors.

- Colorado: Addition of 169 claims, following statewide unemployment trends.

III. Implications of Unemployment Data

- For the Economy:

- A Leading Indicator: Changes in unemployment claims often signal shifts in labor market conditions before these appear in broader indicators like GDP or inflation.

- Policy Adjustments: Regions with rising unemployment may require targeted fiscal policies, such as workforce retraining programs or business incentives.

- For Businesses:

- Market Adaptation: Unemployment trends guide businesses in adjusting hiring strategies and resource allocations.

- Labor Market Dynamics: A tighter labor market, indicated by lower unemployment rates, can pose recruitment challenges for employers.

- For Job Seekers:

- Financial Relief: Timely filing for unemployment benefits ensures financial support during job transitions.

- Career Opportunities: Industry-specific data helps job seekers identify growing sectors for reemployment.

IV. Future Projections and Strategies

- Seasonal Impacts:

- Post-holiday layoffs in retail and service sectors may temporarily elevate claims.

- Winter weather typically affects industries like construction and transportation, influencing regional trends.

- Strategies to Reduce Unemployment Rates:

- Upskilling Programs: Investment in training programs for high-demand sectors.

- Small Business Support: Increased access to funding and tax incentives for sustaining employment levels.

V. Conclusion

Unemployment insurance data provides critical insights into the health of the U.S. economy and labor market. This week’s report highlights the need for proactive measures to address rising claims in certain states while leveraging opportunities in recovering industries.

Stay updated with the latest reports from the U.S. Department of Labor to understand ongoing trends and their implications.