- The Canadian Dollar found thin gains on Wednesday.

- Canada market flows remain thin, and no meaningful CAD data is on the docket.

- US inflation figures due later in the week remain the key risk event.

The Canadian Dollar (CAD) edged higher on Wednesday, bolstered more by a general uptick in broad-market risk appetite and a bullish reversal in Crude Oil than anything related to a shift in CAD sentiment. Federal Reserve (Fed) Chairman Jerome Powell made his second of two appearances in as many days before US Congressional financial committees, delivering the Fed’s latest Semi-Annual Monetary Policy Report.

Canada has had a quiet week on the economic calendar, and the trend of data-less CAD trading is set to continue until next week’s Canadian inflation print set for next Tuesday, with Canadian Retail Sales far-flung to next Friday. In the meantime, a key print in US inflation figures will dominate market flows this week, with US Consumer Price Index (CPI) inflation and Producer Price Index (PPI) wholesale inflation slated for this Thursday and Friday, respectively.

Daily digest market movers: Canadian Dollar softly bolstered by step-up in market risk appetite

- CAD traders are settled in for the long wait for Canadian CPI inflation numbers due next week.

- Data-light CAD finds support from rising Crude Oil bids on Wednesday plus a general improvement in investor sentiment during the midweek market session.

- Fed Chair Powell stuck close to his familiar script during his two-day testimony before US Congressional committees while delivering the Fed’s latest Monetary Policy Report.

- Fed Chair Powell noted that while the Fed still wants more confidence that inflation will ease to the US central bank’s 2% annual inflation target, that doesn’t necessarily mean the Fed will wait until inflation has hit 2% to begin easing rates.

- However, Fed Chair Powell warned that despite easing inflation and a softening labor market, housing and shelter inflation remains a concern.

- According to the CME’s FedWatch Tool, rate traders are still leaning fully into a September rate cut, with markets pricing in at least a 25 basis point trim to the fed funds rate on September 18.

- Jerome Powell Speech: Chairman testifies before House Financial Services Committee

CANADIAN DOLLAR PRICE TODAY

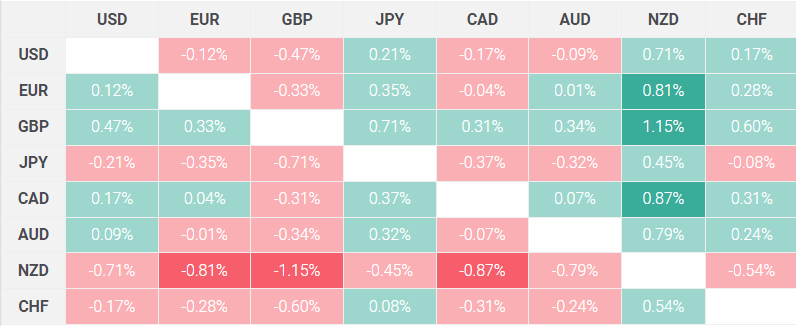

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Canadian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CAD (base)/USD (quote).

Technical analysis: Canadian Dollar dragged slightly higher by broader market forces

The Canadian Dollar (CAD) traded a step higher than the US Dollar (USD) on Wednesday, up a thin sixth of a percent against the Greenback. The CAD softened around three-tenths of one percent against the bullish Pound Sterling (GBP), and the Canadian Dollar benefits from broad-market selling pressure forcing the New Zealand Dollar (NZD) lower. The CAD is up nearly nine-tenths of one percent against the NZD on Wednesday.

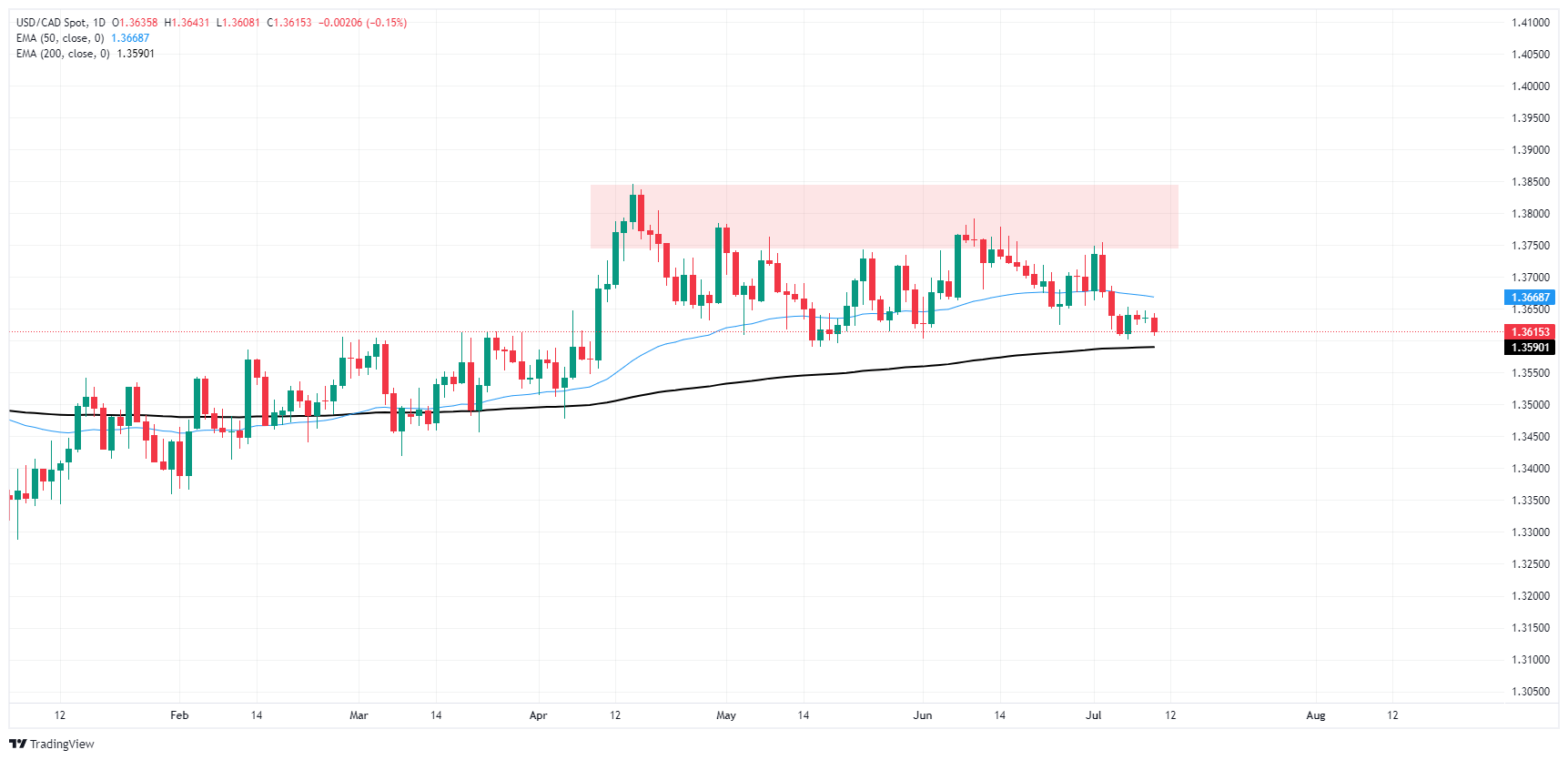

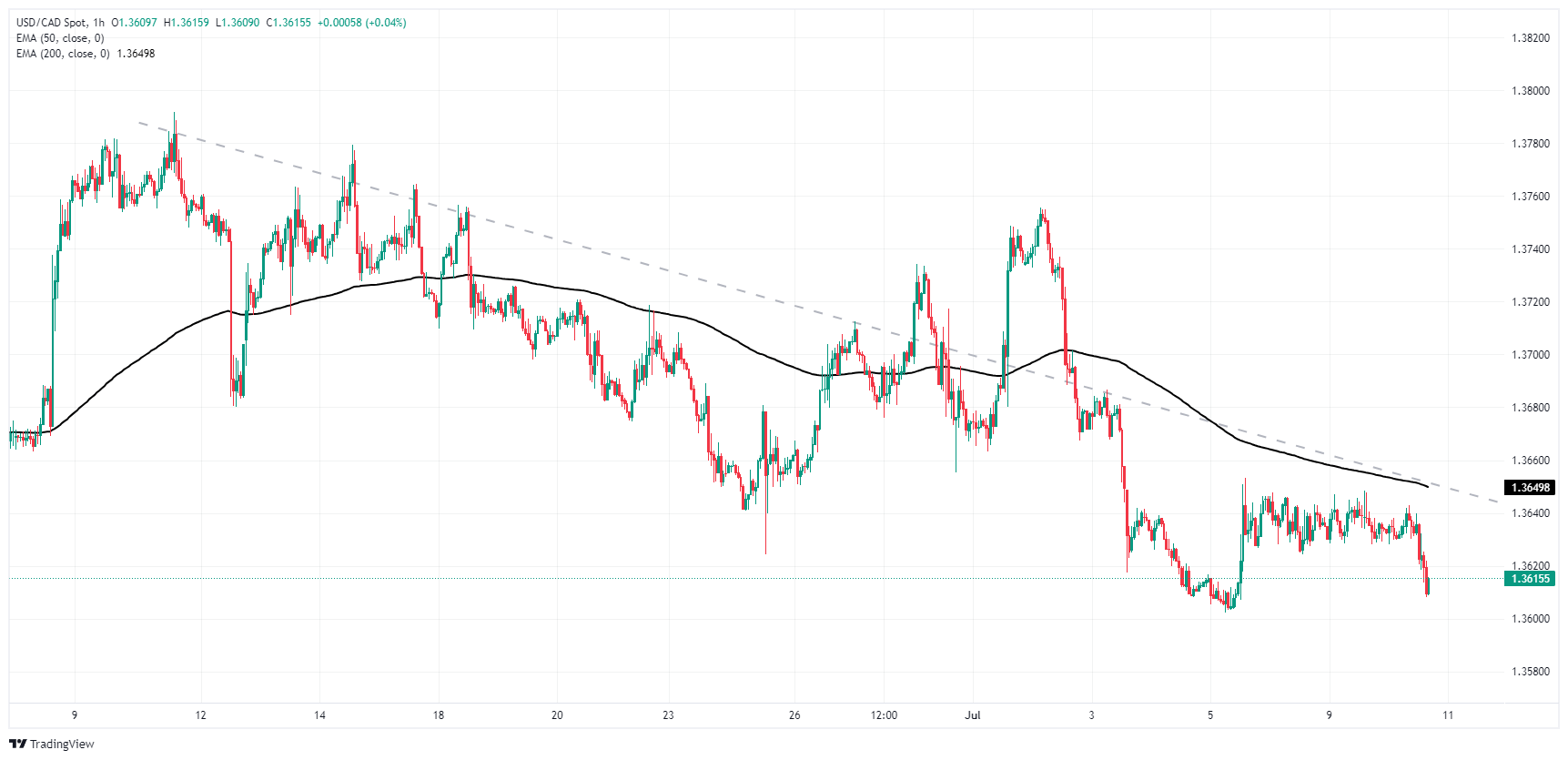

USD/CAD continues to churn just above 1.3600, but near-term short pressure has pushed the USD lower against the CAD, sending the pair down from intraday consolidation near 1.3640. Daily candlesticks continue to drift down toward the 200-day Exponential Moving Average (EMA) at 1.3590 as bids get squeezed between the long-term moving average and a supply zone priced in above 1.3750.

USD/CAD hourly chart

USD/CAD daily chart