The S&P Global PMI report for December 2024 paints a positive picture of the US economy, ending the year with significant growth. The overall PMI reached 56.6, marking the highest level in 33 months. This growth was primarily driven by the services sector, which saw its business activity soar, while the manufacturing sector continued to face challenges. In this article, we will analyze the key points of the PMI report, discuss its implications for the economy, and explore what the outlook for 2025 might look like.

Key Highlights from the December 2024 PMI Report

1. US Economy Reaches a 33-Month High in Output Growth

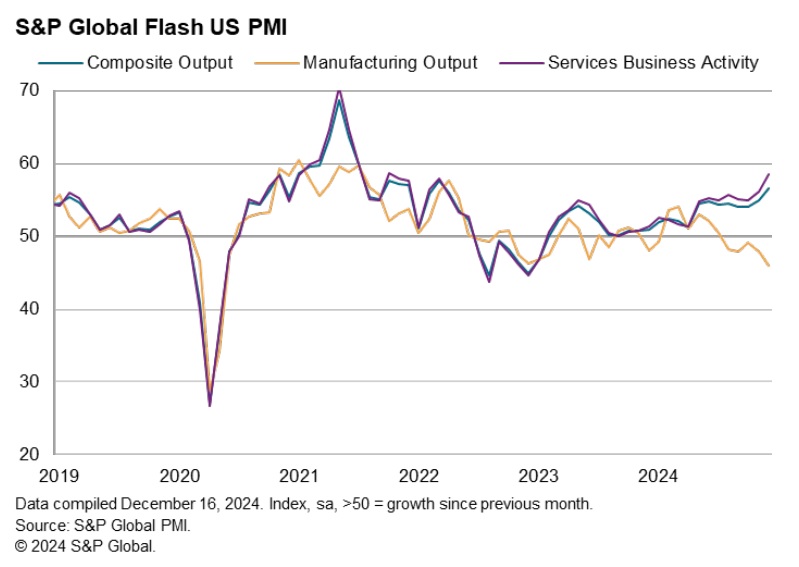

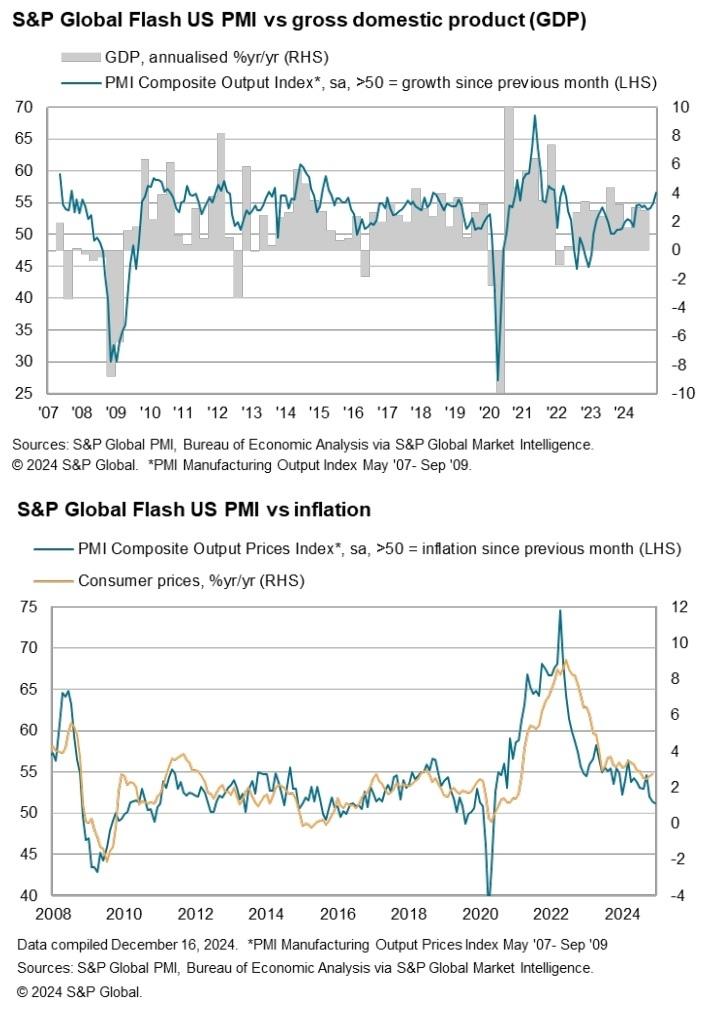

The composite PMI index, a critical measure of overall business activity, rose from 54.9 in November to 56.6 in December, signaling the fastest expansion in nearly three years. This increase in activity is largely attributed to a surge in services, which continued to grow robustly, reflecting a strong recovery in the sector. New orders rose sharply in December, marking the fastest pace of growth since April 2022.

2. Services Sector Leading the Charge

The services sector saw significant expansion, with the Services PMI reaching 58.5, the highest figure in 38 months. This increase is a direct result of stronger domestic demand, contributing to the overall positive outlook for the economy. The services industry, encompassing sectors like finance, real estate, transportation, and communications, has proven to be a cornerstone of the economic recovery in the US.

3. Manufacturing Sector Struggles

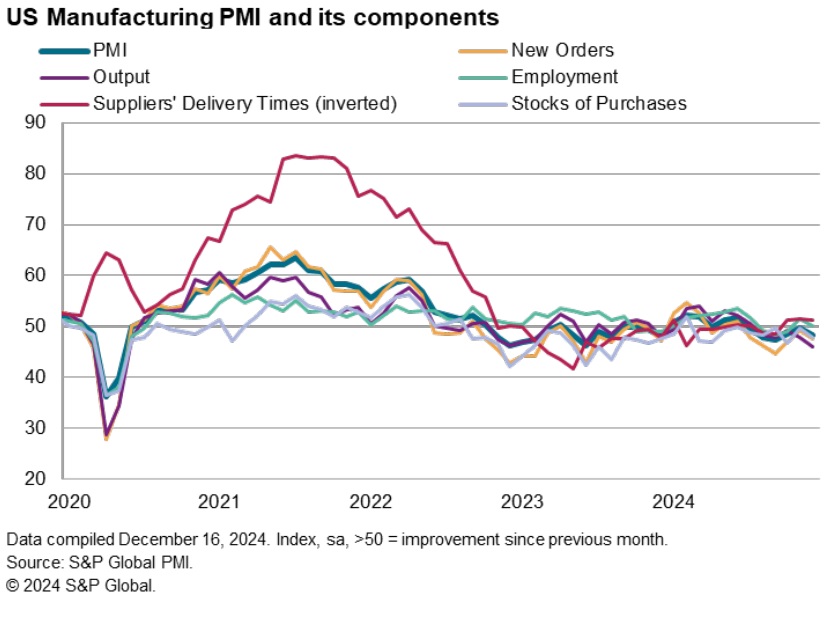

In contrast to the thriving services sector, the manufacturing sector is grappling with multiple challenges. The Manufacturing PMI decreased from 49.7 in November to 48.3 in December, marking a decline for the sixth consecutive month. Production levels dropped at the fastest rate since May 2020, and new orders in manufacturing also fell. This continued contraction in the manufacturing sector points to broader issues such as weak export demand and higher input costs, which have added strain on the industry.

The manufacturing downturn also comes amid ongoing concerns about inflation and supply chain disruptions, which have made raw material costs spike. While services managed to keep inflationary pressures in check, manufacturing faced much steeper increases in input costs, including higher prices for raw materials and shipping.

Economic Implications and Sector Performance

1. The Role of Services in Economic Growth

The robust performance of the services sector is a key driver of overall economic growth in the US. As businesses in sectors like finance, insurance, and business services expand, the overall economy has been able to continue its recovery. In fact, the growth in the services sector was so significant in December that it was the highest observed since October 2021. This boost in business activity highlights the resilience of the service-oriented part of the economy, which has helped mitigate the weaker performance of manufacturing.

2. Manufacturing Faces Challenges Amid Global Uncertainty

While services surged, the manufacturing sector’s performance is concerning. Production has continued to decline due to various challenges, including weaker global demand and higher production costs. The decrease in manufacturing activity is one of the sharpest declines seen since the 2008 financial crisis. This sector’s struggles are compounded by concerns over the effects of potential tariffs, which could worsen the cost pressures manufacturers are already facing.

The fact that manufacturing output fell despite a slight increase in employment within the sector indicates that even though businesses are hiring, they are still struggling to meet demand. The situation calls for broader structural adjustments within the industry, including addressing supply chain vulnerabilities and boosting export demand.

The Economic Outlook for 2025

Looking ahead to 2025, there is cautious optimism about the US economy. The forward-looking sentiment indicators from the PMI survey suggest that businesses expect growth to continue in the coming year. The outlook for services remains particularly strong, with confidence in the sector reaching its highest point in over two years. Meanwhile, the manufacturing sector also saw an improvement in its future expectations, despite its current struggles.

The optimistic outlook is likely influenced by the clear path for economic policies under the incoming administration. As the election uncertainty subsides, businesses are becoming more confident in the stability of economic policies, particularly those that support a business-friendly environment. The prospect of reduced regulation and potential protectionist policies may help improve business confidence.

However, there are concerns, particularly in the manufacturing sector, about the potential negative impacts of trade tariffs and inflation on demand and costs. As the US economy moves into 2025, it will be essential to address these challenges and ensure that both services and manufacturing can contribute to balanced growth.

Inflationary Pressures and Price Dynamics

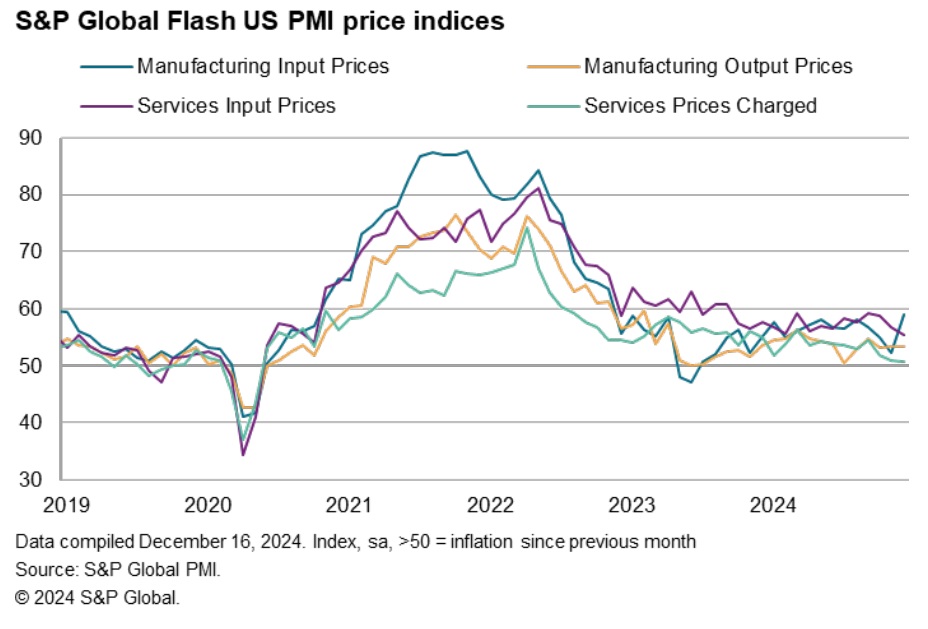

Another important takeaway from the December PMI report is the cooling of inflationary pressures in the US economy. While input costs for manufacturing rose sharply, inflation in the services sector eased significantly. Average prices for goods and services in the overall economy rose at the slowest rate since June 2020, a sign that the most extreme inflationary pressures are starting to moderate.

This moderation in inflation is encouraging, especially given the significant price increases that have affected many industries over the past year. With services driving much of the economic activity, the lower inflation rates in this sector have helped balance out the more substantial cost increases in manufacturing. However, ongoing supply chain disruptions and the potential impact of higher material costs could keep inflationary pressures from fully subsiding in the near term.

Conclusion: The US Economy in 2024 and Beyond

The December 2024 PMI report paints a picture of a US economy that is showing strong growth, particularly in the services sector. While manufacturing faces significant challenges, overall economic activity is expanding at its fastest rate in three years, driven by strong demand in services. Looking ahead to 2025, businesses are optimistic about future growth, although risks in the manufacturing sector remain. Addressing inflation, global demand, and potential tariff impacts will be key to ensuring sustained economic growth in the year ahead.

As the US economy continues its recovery, balancing the growth of both the services and manufacturing sectors will be crucial for maintaining momentum. With positive sentiment and key structural adjustments in place, 2025 could be another year of progress for the US economy, despite the challenges that still lie ahead.